Binary trading lately more and more popular, this is due to the ease and simplicity offered trading procedures. Binary is derived from the binary, ie the numbers 0 and 1. Which can be interpreted any (profit) or not (loss).

It is not as complicated as trading in general, which should have the ability to determine the value of take profit, stop loss value, number of lots, adequacy of capital (money management), and various other complexities, binary trading is very simple. Trader prosecuted only able to predict whether prices will go up or down a few hours ahead.

In binary trading, trading based on the value of the contract, not a lot. Please choose whether you want a contract worth $ 50 or $ 1000, depending on the adequacy of capital and the confidence level of prediction.

If believed to be within 1 hour ahead price will go up then purchased the contract CALL, otherwise if the price is believed to be down then purchased the contract PUT. The contract will expire in 1 hour and if the prediction is true then the profits will be obtained which ranged from 65% to 85%. Whereas if one prediction you will get 0% to 10% of capital at stake to buy the contract.

For example, in 1 hour ahead predicted that prices would go up then buy EURUSD CALL contracts valued at $ 1000 with a payout of 85%. The contract will expire next 1 hour, if the prediction is true then it will obtain profit of $ 850 at the time the contract expired. However, if the prediction is wrong, then is left of the capital is only $ 50.

Easy and very simple right?

No need to bother looking at the chart continuously, do not have to worry about stop losses, do not have to wait long for maximum profit for the first hour has expired contract and the profit has been received, and the most interesting is a larger profit than usual trading.

When calculated with a payout of 75% (in the money) and return 10% (out of the money), with a capital stake of $ 1000 you will get profit of $ 750 if the prediction is true and the loss of $ 900 if the prediction is wrong.

If the above calculation is analogous to the forex, it's the same with take profit of 75 pips and 90 pips stop loss. Indeed, the risk return ratio (RR) is not balanced because the value is greater than the value of stop losses take profit. But the potential for profit can earn 75 pips in less than an hour, would be very interesting.

For those who are accustomed to forex trading, of course, well aware that to obtain a 75 pip profit on forex trading, the chances of the day is only 1 or 2 times that in the event of trending.

Forex market in a day tend to move sideways so that the profit generated is generally around 20 - 50 pips for one entry. Later in the event of a new trending above 50 pips profit then eventually can be obtained. EURUSD moving average in a day is only about 120 pips, so to get above 50 pip profit for one entry only possible if the trending.

Compare this with the binary trading, the potential profit gain 65 sd 85 pips can be obtained every hour. Tempting is not it?

Recently a site in Australia to introduce a binary trading, which is not limited to trading only, but including the trading of stocks and indexes various major American stock exchanges.

Minimum capital required for trading in TradeSmarter only $ 100 and the contract is the minimum that can be purchased for $ 50. Interesting, because it does not need big capital. Deposit capital was too easy, you can use Credit Card, MoneyBookers, or bank transfer.

Almost for a week I noticed and studied the movement and how it trades. Very easy and simple as that done fairly determine the value of the contract to be purchased and predict the direction of the price of 1 hour.

Imagine how much potential that can be obtained in a day as long as the predictions are always right. Let's just use a capital of $ 250 and purchased the contract is valued at $ 100 EURUSD continuously for 10 hours of trading with an average payout of 75%.

Do 10 hours a day with trading the profit earned of $ 750. Compare done when regular trading, it is very difficult, not only with capital of $ 100 and can earn $ 750 profit in a day or 750% profit.

When wrong predictions, no more custom rear stop losses and hope against hope that the trend back toward the original. The amount of loss will remain limited and thus the overall capital exhausted to stay awake and not total due to improper trading only once.

However, to be able to earn consistent profits is not easy. Necessary skills at a very accurate prediction and precision. For those who have been accustomed to doing scalping, certainly not a difficult thing to determine the direction of the price of one hour ahead so as to obtain consistent profit.

Binary trading can also be used as an alternative to trading forex. During this week besides the EURUSD trading in Metatrader, I was also fun to make your own simulation predictions guesswork PUT and CALL:)

Later when it is getting trained, while waiting for entry or exit is right in Metatrader, then as an effort to fill the time just do it binary trading. After all, capital is small and the results are far more tolerable, as long as capable of accurate predictions.

Great potential and the restrictions on the amount of loss that drew me to write it, who knows there is interest among readers.

Journey creating profitable forex robot

It doesn't matter how slowly I go, as long as I don't stop and always do with all of my heart

The greatest weakness lies in giving up, but certain way to succeed is always to try just one more time

Saturday, December 17, 2011

Monday, December 12, 2011

Multi Brokers Test #6

This morning the entire account on the trials comparing various brokers who use 0.01 lots and 1250 capital experienced a considerable loss of $ 150. Because of this the Blessing EA stop trading activity due to equity protection feature is triggered.

Due to the test this time only used one pair only, research the cause of the loss is easier than ever before. Here below is a detailed history of trades:

Blessing seen yesterday doing 5 times entry and all is Buy. Though yesterday was very obvious EU is downtrend. But Blessing did Buy entry, it is definitely going the wrong direction and experience loss.

Blessing also did martingale method which increases continuously lot though entry is clearly in wrong direction. Consequently floating loss becomes very large over time due to many times entry which against the direction of the trend and compounded by raising the number of lots.

This is why equity protection is then triggered and finally the whole trading activity is automatically terminated by the Blessing.

From the above, it can be concluded that the Blessing requires a huge capital to withstand losses if the trend continuously moving in one direction just as it did yesterday.

In contrast to conditions in the last week which Blessing performance is very good due to the trend moved up and down within a narrow radius and not move only in one direction as it did yesterday.

Here below is the Open Trades this morning from FigFX broker:

Seen that although the floating loss has reached $ 2000 but entry is still left open to wait for the trend reversed.

In FigFX and FxPro used capital of 50 thousand with 0.1 lot so the ability to withstand floating loss on two accounts is greater due to capital employed is very large.

When compared with trades history above, because of insufficiency of capital then Blessing just do martingale up to 0.06 lots. But in FigFX and FxPro able to do up to 0.08 lots (0.8 lot divided by 10).

So that means when capital is still enough, Blessing will perform a continuous martingale although it will result in a large floating loss. And if equity limit is reached then the protection will be closed all open trades and trading activity is stopped.

This is what happens to a broker that uses 0.01 lot which at the time of loss has reached $ 150 or 12% (150: 1250) when equity protection feature is triggered. While on a broker that uses a large capital, although the loss has reached 2000 or 4% (2000: 50 thousand), equity protection is still not triggered and the open trades are not close.

From the above, it can be concluded that there are 2 main factors that support the performance of Blessing. First, trend condition itself and the second the existence of sufficient capital.

When the trend moves up and down within a narrow range as in the last week then the Blessing chances would be greater to survived, because floating loss will soon turn into a profit due to the trend reversed.

However, if the entry moves only in one direction just as it did yesterday then Blessing requires huge capital in order to remain able to withstand floating loss. If capital is not sufficient then the equity protection feature will be triggered and all entries will be in close so floating loss will immediately become realize loss.

For those interested to use the Blessing on the live account, be aware of the trend conditions. Never use Blessing if trends move faster in one direction only because if capital is not sufficient then it is definitely going to erode capital.

The results of the trial yesterday has shown us all one of the weaknesses of Blessing. Therefore, let us monitor the trial along with comparisons on the following days to find out whether there are other weaknesses of Blessing.

Due to the test this time only used one pair only, research the cause of the loss is easier than ever before. Here below is a detailed history of trades:

Blessing seen yesterday doing 5 times entry and all is Buy. Though yesterday was very obvious EU is downtrend. But Blessing did Buy entry, it is definitely going the wrong direction and experience loss.

Blessing also did martingale method which increases continuously lot though entry is clearly in wrong direction. Consequently floating loss becomes very large over time due to many times entry which against the direction of the trend and compounded by raising the number of lots.

This is why equity protection is then triggered and finally the whole trading activity is automatically terminated by the Blessing.

From the above, it can be concluded that the Blessing requires a huge capital to withstand losses if the trend continuously moving in one direction just as it did yesterday.

In contrast to conditions in the last week which Blessing performance is very good due to the trend moved up and down within a narrow radius and not move only in one direction as it did yesterday.

Here below is the Open Trades this morning from FigFX broker:

Seen that although the floating loss has reached $ 2000 but entry is still left open to wait for the trend reversed.

In FigFX and FxPro used capital of 50 thousand with 0.1 lot so the ability to withstand floating loss on two accounts is greater due to capital employed is very large.

When compared with trades history above, because of insufficiency of capital then Blessing just do martingale up to 0.06 lots. But in FigFX and FxPro able to do up to 0.08 lots (0.8 lot divided by 10).

So that means when capital is still enough, Blessing will perform a continuous martingale although it will result in a large floating loss. And if equity limit is reached then the protection will be closed all open trades and trading activity is stopped.

This is what happens to a broker that uses 0.01 lot which at the time of loss has reached $ 150 or 12% (150: 1250) when equity protection feature is triggered. While on a broker that uses a large capital, although the loss has reached 2000 or 4% (2000: 50 thousand), equity protection is still not triggered and the open trades are not close.

From the above, it can be concluded that there are 2 main factors that support the performance of Blessing. First, trend condition itself and the second the existence of sufficient capital.

When the trend moves up and down within a narrow range as in the last week then the Blessing chances would be greater to survived, because floating loss will soon turn into a profit due to the trend reversed.

However, if the entry moves only in one direction just as it did yesterday then Blessing requires huge capital in order to remain able to withstand floating loss. If capital is not sufficient then the equity protection feature will be triggered and all entries will be in close so floating loss will immediately become realize loss.

For those interested to use the Blessing on the live account, be aware of the trend conditions. Never use Blessing if trends move faster in one direction only because if capital is not sufficient then it is definitely going to erode capital.

The results of the trial yesterday has shown us all one of the weaknesses of Blessing. Therefore, let us monitor the trial along with comparisons on the following days to find out whether there are other weaknesses of Blessing.

Sunday, December 11, 2011

Million Dollar Pips ( MDP ) #3

Starting tomorrow will be performed in addition to trials comparing various brokers, also will be a retest of the Million dollar Pips (MDP) EA donation from Mr. Hadi.

In previous trials, MDP EA gives poor results which are very rarely do entry exit and just silent. Previous trials used 2 pieces of MDP EA, version 1.1.0. and version 2.1.2 where in each EA conducted trials with 4 different settings as described by its manual book below:

Therefore, in addition to the test tomorrow back by using a broker VantageFX also tested in Pepperstone broker with ECN Account as benchmarking the performance of this EA.

ECN Accounts Pepperstone system using a mixture of spreads and commissions where the spreads tend to be smaller (usually less than 1 pip) due to separate these components into 2 pieces and not like in general (VantageFX, GoMarkets, etc.) which uses only one component, spread.

With the spread is very small it is expected that MDP EA can provide entry-exit far more than before. Therefore, repeated testing is not only done in VantageFX alone, but used also Pepperstone to know the difference.

Also to be tested is Trap EA contribution from Mr. Samuti which previously had difficulty on entry exit. Hopefully after the repair, tomorrow EA trap may work better than last week.

Starting tomorrow the whole trial EAs mentioned above can be monitored at these links in real time: ea.andromeda-trading.com

In previous trials, MDP EA gives poor results which are very rarely do entry exit and just silent. Previous trials used 2 pieces of MDP EA, version 1.1.0. and version 2.1.2 where in each EA conducted trials with 4 different settings as described by its manual book below:

Therefore, in addition to the test tomorrow back by using a broker VantageFX also tested in Pepperstone broker with ECN Account as benchmarking the performance of this EA.

ECN Accounts Pepperstone system using a mixture of spreads and commissions where the spreads tend to be smaller (usually less than 1 pip) due to separate these components into 2 pieces and not like in general (VantageFX, GoMarkets, etc.) which uses only one component, spread.

With the spread is very small it is expected that MDP EA can provide entry-exit far more than before. Therefore, repeated testing is not only done in VantageFX alone, but used also Pepperstone to know the difference.

Also to be tested is Trap EA contribution from Mr. Samuti which previously had difficulty on entry exit. Hopefully after the repair, tomorrow EA trap may work better than last week.

Starting tomorrow the whole trial EAs mentioned above can be monitored at these links in real time: ea.andromeda-trading.com

Multi Brokers Test #5

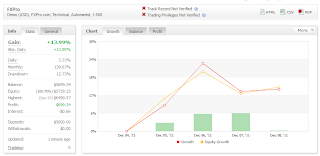

Here below is the result of the comparison STP/ECN brokers until the end of this week:

Visible VantageFX still superior, but differ slightly with Pepperstone Standard Acccount. While GoMarkets is ranked lowest possible this is because in the current time GoMarkets applying a higher spread than other STP/ECN brokers.

While other brokers comparative trial result is below:

VantageFX was still the most superior. While the lowest ranking is RoboForex. On several occasions, always turns FigFX or RoboForex on the lowest ranked. Sometimes FigFX in the lowest rankings, but the next day RoboForex be replaced by the lowest ranking.

What is surprising in the end result where InstaForex match Pepperstone.

Because yesterday at FxPro occur due to a margin call due to insufficient capital, then starting tomorrow will be re-trial comparisons. Where in addition to the above brokers, IBFX Australia will be added as an additional broker to be tested.

The entire broker use 1:500 exception Pepperstone and IBFX Australia that use leverage 1:400. Capital will be understated which only use 1250 for a broker who apply 0.01 lots and 12 500 for a broker that uses 0.1 lots. This is done in order to obtain the similarity parameters so that comparisons can be made with the same condition on all brokers.

Special treatment to InstaForex, although the capital only 1250 but will used 0.1 lot and not 0.01. This is because InstaForex used micro accounts so in order to obtain the same effect as other brokers then raised to 0.1 lots.

Which will be used as a test tool is the Blessing EA which will only use one pair only (EU). It is not like in previous trials which used 4 pair.

Starting tomorrow, comparative trial on the broker can be monitored in real time on this link: ea.andromeda-trading.com

Visible VantageFX still superior, but differ slightly with Pepperstone Standard Acccount. While GoMarkets is ranked lowest possible this is because in the current time GoMarkets applying a higher spread than other STP/ECN brokers.

While other brokers comparative trial result is below:

VantageFX was still the most superior. While the lowest ranking is RoboForex. On several occasions, always turns FigFX or RoboForex on the lowest ranked. Sometimes FigFX in the lowest rankings, but the next day RoboForex be replaced by the lowest ranking.

What is surprising in the end result where InstaForex match Pepperstone.

Because yesterday at FxPro occur due to a margin call due to insufficient capital, then starting tomorrow will be re-trial comparisons. Where in addition to the above brokers, IBFX Australia will be added as an additional broker to be tested.

The entire broker use 1:500 exception Pepperstone and IBFX Australia that use leverage 1:400. Capital will be understated which only use 1250 for a broker who apply 0.01 lots and 12 500 for a broker that uses 0.1 lots. This is done in order to obtain the similarity parameters so that comparisons can be made with the same condition on all brokers.

Special treatment to InstaForex, although the capital only 1250 but will used 0.1 lot and not 0.01. This is because InstaForex used micro accounts so in order to obtain the same effect as other brokers then raised to 0.1 lots.

Which will be used as a test tool is the Blessing EA which will only use one pair only (EU). It is not like in previous trials which used 4 pair.

Starting tomorrow, comparative trial on the broker can be monitored in real time on this link: ea.andromeda-trading.com

Saturday, December 10, 2011

Terminal Disconnect

Sometimes experienced broker server disconnects due to various things, like a bad internet connection, the server is reset, or even due to hacker attacks.

As had happened in FxPro some time ago where the server is attacked by hackers and paralyzed. Maybe the hacker by profession as well as a trader, it could be when he suffered loss due to rigged FxPro and then counter-attacked :)

Therefore, always use a broker who has more than 1 piece of the server. If there discconect on one server it can be readily moved to another server. The way to check how many servers are used by the broker is to click on right bottom Metatrader as shown below:

Seen there are 2 pieces of server owned by the broker. If there is disconnect, then immediately moved to another server by clicking on one server or click Rescan.

Rescan function can also be used to perform automatic scanning of speed response of each server. When considered using one of the servers a bit slow, just click Rescan. Metatrader will automatically test and then choose the fastest server.

As had happened in FxPro some time ago where the server is attacked by hackers and paralyzed. Maybe the hacker by profession as well as a trader, it could be when he suffered loss due to rigged FxPro and then counter-attacked :)

Therefore, always use a broker who has more than 1 piece of the server. If there discconect on one server it can be readily moved to another server. The way to check how many servers are used by the broker is to click on right bottom Metatrader as shown below:

Seen there are 2 pieces of server owned by the broker. If there is disconnect, then immediately moved to another server by clicking on one server or click Rescan.

Rescan function can also be used to perform automatic scanning of speed response of each server. When considered using one of the servers a bit slow, just click Rescan. Metatrader will automatically test and then choose the fastest server.

Cheap VPS

In a few months ago by this blog SWVPS.com recommended if you want to use the VPS because the price is cheaper than most other VPS hosting, but current conditions have shifted and there is another VPS Hosting is capable of providing much cheaper price.

Below is a table VPS prices offered by SWVPS.com:

Compare with a table of prices offered by UCVHOST.com are much cheaper:

The price offered by UCVHOST.com for VPS Lite is $ 9.99, or nearly half of WVPS-1 SWVPS.com offering a price of $ 18.

In choosing a VPS is used for the purposes testing EA, the sufficient memory is a main factor for choosing in which the SWVPS.com offers 1 GB of memory while in UCVHOST.com only 768 MB but the price is different almost 2-fold.

With 768 MB memory is enough to use up to 10 EA running at 10 different Metatrader on the same times. So of course VPS offered by UCVHOST.com become more attractive than those offered by SWVPS.com.

In addition UCVHOST.com also offer a special VPS for Forex as shown in the figure below:

When compared to the specification of Lite Forex VPS and VPS Lite offered by UCVHOST.com is no different where both have 768MB memory, 10GB disk space and 500GB bandwidth. Well, where is the difference? Why Forex VPS Lite subscription fees per month more expensive $ 2?

Well, it turns out the difference lies in Metatrader installation. Where on VPS Lite is not installed while on the Forex Metatrader VPS Lite is installed.

This is actually ridiculous because to do install Metatrader occurs only once during the first use of VPS and only takes a less than 5 minutes. Only for this, will cost you $ 2 per month more expensive than VPS Lite.

Another option is to use a VPS Commercial Network Services (CNS) which is very popular in the Forex world because a lot of forex traders who use it.

CNS popular due to excess are more reliable than other VPS Hosting where "said" never happened disconnection and always guaranteed online continuously. But VPS subscription fee in the CNS is much more expensive than others as shown in the picture below:

Seen that the CNS offers 2 choices of VPS Value Edition 384MB memory is priced at $ 30 and VPS 512MB Memory Standard Edition is priced at $ 65.

Compared with the VPS Lite UCVHOST.com which has 768MB of memory, of course, when 512 just sold for $ 65 then that uses 768MB of memory should the price is about $ 75.

From this comparison can finally concluded that CNS VPS price was 7.5 times more than other VPS Hosting reasonable prices which available on the market. Insanely expensive:)

Choose which one?

Depend on your pockets and your needs :)

Below is a table VPS prices offered by SWVPS.com:

Compare with a table of prices offered by UCVHOST.com are much cheaper:

The price offered by UCVHOST.com for VPS Lite is $ 9.99, or nearly half of WVPS-1 SWVPS.com offering a price of $ 18.

In choosing a VPS is used for the purposes testing EA, the sufficient memory is a main factor for choosing in which the SWVPS.com offers 1 GB of memory while in UCVHOST.com only 768 MB but the price is different almost 2-fold.

With 768 MB memory is enough to use up to 10 EA running at 10 different Metatrader on the same times. So of course VPS offered by UCVHOST.com become more attractive than those offered by SWVPS.com.

In addition UCVHOST.com also offer a special VPS for Forex as shown in the figure below:

When compared to the specification of Lite Forex VPS and VPS Lite offered by UCVHOST.com is no different where both have 768MB memory, 10GB disk space and 500GB bandwidth. Well, where is the difference? Why Forex VPS Lite subscription fees per month more expensive $ 2?

Well, it turns out the difference lies in Metatrader installation. Where on VPS Lite is not installed while on the Forex Metatrader VPS Lite is installed.

This is actually ridiculous because to do install Metatrader occurs only once during the first use of VPS and only takes a less than 5 minutes. Only for this, will cost you $ 2 per month more expensive than VPS Lite.

Another option is to use a VPS Commercial Network Services (CNS) which is very popular in the Forex world because a lot of forex traders who use it.

CNS popular due to excess are more reliable than other VPS Hosting where "said" never happened disconnection and always guaranteed online continuously. But VPS subscription fee in the CNS is much more expensive than others as shown in the picture below:

Seen that the CNS offers 2 choices of VPS Value Edition 384MB memory is priced at $ 30 and VPS 512MB Memory Standard Edition is priced at $ 65.

Compared with the VPS Lite UCVHOST.com which has 768MB of memory, of course, when 512 just sold for $ 65 then that uses 768MB of memory should the price is about $ 75.

From this comparison can finally concluded that CNS VPS price was 7.5 times more than other VPS Hosting reasonable prices which available on the market. Insanely expensive:)

Choose which one?

Depend on your pockets and your needs :)

Multi Brokers Test #4

Today FxPro experienced loss account due to insufficient capital due to the use of 0.1 lots. If on the other brokers use 0.01 lots with a capital of 5000, so if you use 0.1 lot (10 times) should be used capital of 50 thousand in order to keep your account secure.

Just as in FigFX who also use 0.1 lot where capital employed is 50 thousand, so the account remains secure and does not experience loss due to insufficient capital. As a result of this incident then the comparison becomes no longer comparable. FxPro showed poor results only due to insufficient capital employed.

The results of comparison for 4 days on the image above shows the performance of EA's Blessing on the various brokerage almost comparable, except VantageFX leaving others. RoboForex also managed to balance with the others and not as bad as a few days ago. Current conditions indicate precisely FigFX was ranked lowest, replacing RoboForex.

However, due to events FxPro experienced loss due to insufficient capital, then this trial will be reset and used the new capital on Sunday tomorrow. Where to apply for a broker who will use 0.01 lots of capital of 5 thousand and brokers who use 0.1 lot will be used 50 thousand capital.

Just as in FigFX who also use 0.1 lot where capital employed is 50 thousand, so the account remains secure and does not experience loss due to insufficient capital. As a result of this incident then the comparison becomes no longer comparable. FxPro showed poor results only due to insufficient capital employed.

The results of comparison for 4 days on the image above shows the performance of EA's Blessing on the various brokerage almost comparable, except VantageFX leaving others. RoboForex also managed to balance with the others and not as bad as a few days ago. Current conditions indicate precisely FigFX was ranked lowest, replacing RoboForex.

However, due to events FxPro experienced loss due to insufficient capital, then this trial will be reset and used the new capital on Sunday tomorrow. Where to apply for a broker who will use 0.01 lots of capital of 5 thousand and brokers who use 0.1 lot will be used 50 thousand capital.

Tuesday, December 6, 2011

Multi Brokers Test #3

There is a strange thing when watching the results of testing several brokers.

Seen in the picture below RoboForex and InstaForex is a broker that gives the smallest gains and very different from other brokers.

In order to know the cause, here below than trades history VantageFX and InstaForex:

History of trades is only selected entry using 0.01 lots to facilitate research.

Seen in VantageFX, entry with 0.01 lots generate profit 34 pips then the value of USD is also 3.4. Thus concluded that by using 0.01 lots then 1 pip = $ 0.1. Therefore profit 34 pips profit generated $ 3.4 and $ 2.8 produces 2.8 pips.

While on InstaForex, entry is 0.01 lots with 35 generating profit $ 0.35 and not $ 3.5 as at VantageFX above. Thus concluded that this is a micro account / mini account and not a standard account as in VantageFX above.

To calculate Instaforex so the results can be comparable with another broker then must be multiplied by 10. This is the opposite of a broker that uses 0.1 lots which must be divided by 10 first so that results can be compared.

As for RoboForex, the results are as follows:

Visible results are similar to VantageFX RoboForex the entry with 0.01 lots at 35 pips profit generating $ 3.5. Thus concluded that the account on RoboForex is a standard account and not a mini / micro accounts as well as on InstaForex and not need to multiplied by a value of 10.

Thus the correct comparison is based on the image above is as follows:

- ECNProFX_STD +1.45% => +1.45% = $ 72.54

- RoboForex +0.49% => +0.49% = $ 24.44

- InstaForex +0.17% => +1.70% = $ 86 (multiplied 10 - mini account)

- FxPro +16.97% => +1.69% = $ 84.86 (divided 10 - 0.1 lot)

- VantageFX +1.91% => +1.94% = $ 95.57

- Pepperstone_ECN +1.76% => +1.76% = $ 88.15

- FIGfx +1.56% => +1.56% = $ 78.08 (divided 10 - 0.1 lot)

Which still a champion is VantageFX followed by Pepperstone ECN. Imagine if this happens in the long run and that is used is the lowest ranked broker, how many pips that lose on brokers spread :)

The question now, why RoboForex far behind than other brokers? Though the comparable calculations are correct. Probably the closest possibility is because very high spreads are applied resulting in the acquisition of any profit to be very minimal.

I better not say much and remain objective, let alone the Blessing EA prove it :)

We look together at the weekend how the overall result of these broker comparison.

Comparative trial of this broker can be monitored in real time here: ea.andromeda-trading.com

Seen in the picture below RoboForex and InstaForex is a broker that gives the smallest gains and very different from other brokers.

In order to know the cause, here below than trades history VantageFX and InstaForex:

History of trades is only selected entry using 0.01 lots to facilitate research.

Seen in VantageFX, entry with 0.01 lots generate profit 34 pips then the value of USD is also 3.4. Thus concluded that by using 0.01 lots then 1 pip = $ 0.1. Therefore profit 34 pips profit generated $ 3.4 and $ 2.8 produces 2.8 pips.

While on InstaForex, entry is 0.01 lots with 35 generating profit $ 0.35 and not $ 3.5 as at VantageFX above. Thus concluded that this is a micro account / mini account and not a standard account as in VantageFX above.

To calculate Instaforex so the results can be comparable with another broker then must be multiplied by 10. This is the opposite of a broker that uses 0.1 lots which must be divided by 10 first so that results can be compared.

As for RoboForex, the results are as follows:

Visible results are similar to VantageFX RoboForex the entry with 0.01 lots at 35 pips profit generating $ 3.5. Thus concluded that the account on RoboForex is a standard account and not a mini / micro accounts as well as on InstaForex and not need to multiplied by a value of 10.

Thus the correct comparison is based on the image above is as follows:

- ECNProFX_STD +1.45% => +1.45% = $ 72.54

- RoboForex +0.49% => +0.49% = $ 24.44

- InstaForex +0.17% => +1.70% = $ 86 (multiplied 10 - mini account)

- FxPro +16.97% => +1.69% = $ 84.86 (divided 10 - 0.1 lot)

- VantageFX +1.91% => +1.94% = $ 95.57

- Pepperstone_ECN +1.76% => +1.76% = $ 88.15

- FIGfx +1.56% => +1.56% = $ 78.08 (divided 10 - 0.1 lot)

Which still a champion is VantageFX followed by Pepperstone ECN. Imagine if this happens in the long run and that is used is the lowest ranked broker, how many pips that lose on brokers spread :)

The question now, why RoboForex far behind than other brokers? Though the comparable calculations are correct. Probably the closest possibility is because very high spreads are applied resulting in the acquisition of any profit to be very minimal.

I better not say much and remain objective, let alone the Blessing EA prove it :)

We look together at the weekend how the overall result of these broker comparison.

Comparative trial of this broker can be monitored in real time here: ea.andromeda-trading.com

Monday, December 5, 2011

Multi Brokers Test #2

When

the market began running on Monday morning yesterday, the new note that

ECN broker accounts on ECNProFX using 0.1 lots as a minimum lot. Though capital can not be altered and restricted only 1000. As

a result of this is that this account many times experienced loss due

to capital is no longer sufficient to hold the floating loss that

occurs.

It has been predicted before, let alone use 0.1 lot, use a smaller lot that is 0.01 lots with a capital of only 1000 can already lead to a margin call because this Blessing EA has a tendency to hold the floating loss is sufficiently large that adequate capital is necessary in order avoid a margin call.Another broker that capital can not be changed is FigFX where capital has been determined that its value should be 50 thousand and the smallest lot is 0.1 lots.

Another broker that uses the smallest lot is 0.1 lot FxPro. Only in FxPro, the capital value can be changed as the user desires and not from the beginning is determined by the broker as well as on ECN broker account FigFX and ECNProFX above.

Due to the differences in the value of lots and the capital value of the ratio by using a value of USD will be a little difficult when the amount of USD profit should be equated beforehand in order to obtain comparable results to the entire brokerage.For example, below is a summary of the acquisition on EA's Blessing this morning at various broker:

Brokers who use 0.1 lot would certainly tend to have the amount of USD profit or loss is higher than the brokers who use 0.01 lots. In order to obtain results similar comparisons with other brokers on the broker who then use the 0.1 lots, the amount of USD acquisition of profit should be divided by 10 in advance.

As for ECN accounts at brokerage ECNProFX comparisons will not be done due to capital constraints 1000 and due to this many times experienced loss. So the performance of EA's Blessing becomes chaotic and results can not be compared with another broker.

FxPro and FigFX in the image above acquisition profit amounted to 580 and 535. To be compared to the acquisition of profit is first divided by 10 to obtain the FxPro profit amounted to 58 and the profits amounted to 53.5 FigFX

By way of first divided by 10 then comparisons can be made even though there are differences in the use of the lots.

As for the acquisition of Total Pip does not need to be divided by 10 is because regardless of the value of lots that are used, the pip value will remain the same and will not be affected. Differences lot only affect the value of the acquisition of profit or loss in USD.

So based on the above calculation that the FxPro profit amounted to 58 and on FigFX is ranked first at 53.5 then the biggest profit gains in the USD from the picture above is VantageFX of 73.69, followed by ECN Pepperstone 61.82, and FxPro at 58 , 04.

While the first rank in the biggest profit gains Pip is VantageFX by 273, then followed by ECN Pepperstone FxPro 224.2 and then 213.9.

Only Pip acquisition value can not be compared directly with the acquisition of CAD. For example VantageFX 273 pip gain, when 1 pip = USD 1 certainly obtained the profit is USD 273. But the reality, the profit earned only U.S. $ 73.69.

This is because myfxbook do not pip calculation based on the value of lots. Eg 1 time entry with 5 lots and managed to profit 10 pips then by myfxbook acquisition will count 10 pip pip. But when done 5 times each entry with a lot and managed to profit 10 pips then be calculated by myfxbook 50 pips. As a result of this then becomes Pip value is not comparable with a value of USD.

We look together at the weekend how the overall result of these broker comparison.

Comparative trial of this broker can be monitored here: ea.andromeda-trading.com

It has been predicted before, let alone use 0.1 lot, use a smaller lot that is 0.01 lots with a capital of only 1000 can already lead to a margin call because this Blessing EA has a tendency to hold the floating loss is sufficiently large that adequate capital is necessary in order avoid a margin call.Another broker that capital can not be changed is FigFX where capital has been determined that its value should be 50 thousand and the smallest lot is 0.1 lots.

Another broker that uses the smallest lot is 0.1 lot FxPro. Only in FxPro, the capital value can be changed as the user desires and not from the beginning is determined by the broker as well as on ECN broker account FigFX and ECNProFX above.

Due to the differences in the value of lots and the capital value of the ratio by using a value of USD will be a little difficult when the amount of USD profit should be equated beforehand in order to obtain comparable results to the entire brokerage.For example, below is a summary of the acquisition on EA's Blessing this morning at various broker:

Brokers who use 0.1 lot would certainly tend to have the amount of USD profit or loss is higher than the brokers who use 0.01 lots. In order to obtain results similar comparisons with other brokers on the broker who then use the 0.1 lots, the amount of USD acquisition of profit should be divided by 10 in advance.

As for ECN accounts at brokerage ECNProFX comparisons will not be done due to capital constraints 1000 and due to this many times experienced loss. So the performance of EA's Blessing becomes chaotic and results can not be compared with another broker.

FxPro and FigFX in the image above acquisition profit amounted to 580 and 535. To be compared to the acquisition of profit is first divided by 10 to obtain the FxPro profit amounted to 58 and the profits amounted to 53.5 FigFX

By way of first divided by 10 then comparisons can be made even though there are differences in the use of the lots.

As for the acquisition of Total Pip does not need to be divided by 10 is because regardless of the value of lots that are used, the pip value will remain the same and will not be affected. Differences lot only affect the value of the acquisition of profit or loss in USD.

So based on the above calculation that the FxPro profit amounted to 58 and on FigFX is ranked first at 53.5 then the biggest profit gains in the USD from the picture above is VantageFX of 73.69, followed by ECN Pepperstone 61.82, and FxPro at 58 , 04.

While the first rank in the biggest profit gains Pip is VantageFX by 273, then followed by ECN Pepperstone FxPro 224.2 and then 213.9.

Only Pip acquisition value can not be compared directly with the acquisition of CAD. For example VantageFX 273 pip gain, when 1 pip = USD 1 certainly obtained the profit is USD 273. But the reality, the profit earned only U.S. $ 73.69.

This is because myfxbook do not pip calculation based on the value of lots. Eg 1 time entry with 5 lots and managed to profit 10 pips then by myfxbook acquisition will count 10 pip pip. But when done 5 times each entry with a lot and managed to profit 10 pips then be calculated by myfxbook 50 pips. As a result of this then becomes Pip value is not comparable with a value of USD.

We look together at the weekend how the overall result of these broker comparison.

Comparative trial of this broker can be monitored here: ea.andromeda-trading.com

Sunday, December 4, 2011

Multi Brokers Test

Blessing EA forward test results last week gave an idea to use it for testing the various brokers.

Starting today, we will perform tests on the various brokerage VantageFX, Pepperstone ECN Accounts, FxPro, InstaForex, RoboForex, FigFX, and ECNProFX (2 types of accounts - Standard and ECN). By using the EA Blessing of course the trial will be more objective.

0.01 lots will be used entirely and use the capital 5000, with exception of the ECN broker account ECNProFX where capital is used only 1000. This is because the error on demo account registration in which capital can not be changed.

Comparative trial of this broker can be monitored here: ea.andromeda-trading.com

Starting today, we will perform tests on the various brokerage VantageFX, Pepperstone ECN Accounts, FxPro, InstaForex, RoboForex, FigFX, and ECNProFX (2 types of accounts - Standard and ECN). By using the EA Blessing of course the trial will be more objective.

0.01 lots will be used entirely and use the capital 5000, with exception of the ECN broker account ECNProFX where capital is used only 1000. This is because the error on demo account registration in which capital can not be changed.

Comparative trial of this broker can be monitored here: ea.andromeda-trading.com

Saturday, December 3, 2011

STP/ECN Comparison #1

Forward test results on the various brokerage using Blessing EA shows something interesting where the results obtained on each broker showed a significant difference.

Forward test using same EA, same amount of capital (USD 5000), same lot (0.01 lots), same start time, and leverage also almost the same (VantageFX and GoMarkets 1:500 while Pepperstone 1:400). GoMarkets and VantageFX only offers an account that uses a spread and did not offer an account that uses a mix of commissions and spreads (ECN account). While Pepperstone is a broker that offers 2 different types of accounts that is the standard account that uses a spread and ECN account.

The difference of these accounts on the availability of the commission as shown in the figure below:

Seen in the picture above that the VantageFX commission value is 0 and on Pepperstone commission contained.

Generally brokers that offer ECN account is to simply create the illusion as if the spread is low. In fact, the spread is still high but seems to be low because the spread split into two components, commission and spread.

This fact is merely an illusion deliberately created by the broker. The results of forward test on the various brokerage using Blessing EA prove it. Although is used is a demo account but on STP / ECN broker usually between demo and live accounts just the same, there is no difference whatsoever. While on market maker broker usually demo account is likely to be conditioned much better than a live account.

Let us together look forward test the Blessing EA below:

The results above show the highest profit is on VantageFX that is equal to 7.22%. While the lowest occurred on GoMarkets broker is only as much as 5.86%. But Total Pips value showed the highest is on Raw Pepperstone Account where this account is ECN account that uses a mixture of spreads and commissions.

Total Pips obtained on Raw Pepperstone Account is 1914, in merely VantageFX 1688, and the lowest in GoMarkets that is equal to 1303.

Well, certainly the question that arises is why the value of Total Pips VantageFX only 1688 but it has a larger total profits of 5361 (7.22%)?

Total Pips Pepperstone Raw 1914 or 226 pips higher than VantageFX, but oddly enough it has a smaller total profit of 5320 (6.4%). Different Profit 41 (0.82%) is smaller than VantageFX. From this can be concluded that the spread split into 2 components, commission and spread, may cause an illusion as if profit value is very high when just looking only at the Total Pips. When in fact, are even lower due to Total Pips is merely an illusion.

To be more detailed, 4 forward test account is compared below:

Seen that the Daily or Monthly % profit on VantageFX much higher when compared to other brokers. Expentancy statistical value is also higher.

So it can be concluded that using a broker VantageFX far more profitable than using GoMarkets and Pepperstone due to a spread that is used by VantageFX smaller than other brokers. This article is not to promote VantageFX. This article is purely brokers test to show which ones are most profitable. The selection is up to individual taste.

Using a forward test results that has been running for a week to make conclusions it's still too early. We'll see together how the results next week.

Forward test using same EA, same amount of capital (USD 5000), same lot (0.01 lots), same start time, and leverage also almost the same (VantageFX and GoMarkets 1:500 while Pepperstone 1:400). GoMarkets and VantageFX only offers an account that uses a spread and did not offer an account that uses a mix of commissions and spreads (ECN account). While Pepperstone is a broker that offers 2 different types of accounts that is the standard account that uses a spread and ECN account.

The difference of these accounts on the availability of the commission as shown in the figure below:

Seen in the picture above that the VantageFX commission value is 0 and on Pepperstone commission contained.

Generally brokers that offer ECN account is to simply create the illusion as if the spread is low. In fact, the spread is still high but seems to be low because the spread split into two components, commission and spread.

This fact is merely an illusion deliberately created by the broker. The results of forward test on the various brokerage using Blessing EA prove it. Although is used is a demo account but on STP / ECN broker usually between demo and live accounts just the same, there is no difference whatsoever. While on market maker broker usually demo account is likely to be conditioned much better than a live account.

Let us together look forward test the Blessing EA below:

The results above show the highest profit is on VantageFX that is equal to 7.22%. While the lowest occurred on GoMarkets broker is only as much as 5.86%. But Total Pips value showed the highest is on Raw Pepperstone Account where this account is ECN account that uses a mixture of spreads and commissions.

Total Pips obtained on Raw Pepperstone Account is 1914, in merely VantageFX 1688, and the lowest in GoMarkets that is equal to 1303.

Well, certainly the question that arises is why the value of Total Pips VantageFX only 1688 but it has a larger total profits of 5361 (7.22%)?

Total Pips Pepperstone Raw 1914 or 226 pips higher than VantageFX, but oddly enough it has a smaller total profit of 5320 (6.4%). Different Profit 41 (0.82%) is smaller than VantageFX. From this can be concluded that the spread split into 2 components, commission and spread, may cause an illusion as if profit value is very high when just looking only at the Total Pips. When in fact, are even lower due to Total Pips is merely an illusion.

To be more detailed, 4 forward test account is compared below:

Seen that the Daily or Monthly % profit on VantageFX much higher when compared to other brokers. Expentancy statistical value is also higher.

So it can be concluded that using a broker VantageFX far more profitable than using GoMarkets and Pepperstone due to a spread that is used by VantageFX smaller than other brokers. This article is not to promote VantageFX. This article is purely brokers test to show which ones are most profitable. The selection is up to individual taste.

Using a forward test results that has been running for a week to make conclusions it's still too early. We'll see together how the results next week.

Subscribe to:

Comments (Atom)