In any field, there's always a phenomenal event that finally made the legend and talks the talk.

Like the fairy tale Bondowoso 1000 capable of building the temple overnight. The story or legend of heroic Pitung capitalize immunity against the Dutch army. Or the recent phenomenal is the case that Madoff Ponzi scheme to deceive deception can reap billions of dollars.

In forex trading is the same, also has a legend of legends that arise because there are traders who are able to create phenomenal profits in just a short time.

Two years ago before the site is created myfxbook.com, manual trading contest is generally held by each broker, while for the automatic trading robot contest that uses EA (expert advisor) centrally held once a year by MetaQuotes Software (makers of Metatrader). In these contests created forex trading whiz who eventually became a byword.

However, in addition to the legend created by the trading contest, there is also a whiz trader who is able to create phenomenal profits without contest. They became popular and legendary because it does spread trading results in the trading forums.

As I've said by Mr. Hadi, the forex forum myth out there is from 5 dollars to 5120 dollars within a month. I had once read in a site that there is a teacher who comes from China able to turn an initial capital of 1000 to 250 thousand within a month.

Meskpipun sounds like nonsense, but that's a fact that occurred. Trading forex can be tremendous because of the potential contained in forex trading has no restrictions. Profit fantastic in any amount can be created at any time provided that the capabilities and expertise has been owned.

Forex trading can be likened to enter into a gold mine diamonds. Only those who know how to finally be able to successfully bring gold diamond in an infinite number. Meanwhile, for those who still lay, not managed to get gold, but might even peck died from a snake or kejebur cliff:)

As ever written in previous articles, the use of EA was limited as an alternative in trading. Until recently, the ability of EA still far less than human ability. Still not happen things like in the Terminator movies where robots are smarter than humans:)

This is evidenced from the acquisition of the trading profits made by the EA on the Automated Trading Championship since 2006 as shown below:

Seen that a contest winner in 2006 was 2.5 times the profit acquisition of capital, while the highest profit gains in 2008 is 15.9 times capital. Last contest in 2010, the highest profit is only 6.7 times.

In the contest of 2008, participants from Indonesia ranks sixth. A remarkable achievement because of the Automated Trading Championship is usually dominated by participants who came from Russia and Eastern Europe. For some reason could be like that, maybe the Russians and Eastern Europeans are smarter in computer programming.

Automated Trading Championship conducted each year in which the EA is used to make trades during the three months since October sd In December. Currently EA contest is underway and has been running a month, the highest profit is only 5.9 times.

There are participants from Indonesia, which currently stands at rank 14. Hopefully EA can enter it in the top 10 when the contest ends later.

As for manual trading contest that can be used as a benchmark is a contest organized by myfxbook.com. To this day myfxbook.com has held five times a trading contest with the acquisition of the following results:

When observed details of the achievement of profit, it appears that on average ranged between 20 - 30 times within a month. Which is just phenomenal in the second contest where first prize is able to achieve 40 times the acquisition of profit.

From the picture above also shows that at the last contest there were participants from Indonesia who managed to become champion 2 with the acquisition of 29.5 times profit for a month to do a demo trading.

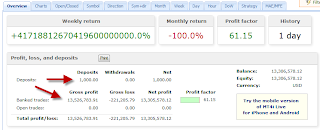

Try if compared to manual trading my own:

Only in 4-day acquisition of profit to 23.5 times, imagine if done for a month. Hopefully it can become the next legend forex:)

From the above matters can be concluded that manual trading gives better results than the automatic trading.

But it would be indisputable if you see the results of automatic trading below:

The initial capital of only U.S. $ 1000 and can be converted into U.S. $ 13.5 million in just less than 7 hours! Plus, it is not done in the demo, but on a live account that khabarnya cause direct broker went bankrupt.

Due to this, the EA indrafxscalping is banned by some brokers and should no longer be used as shown below:

It prohibits the use of multiple brokers EA for the following reasons: "you are most welcome to scalp as long as your EAs has a logical cores and is not listed amongst the Few forbidden EA's and trading strategies below."

Funny how this sentence, "as long as your EAs has a logical cores"

Try then again, EA is merely a computer program. Whatever the name of the program, of course, it takes the logic structure is embedded in it so that later can run either on the computer. How is it created a program that did not use logic? How could EA be made if you do not use logic?

Until I read his own laugh, this is merely a made-up excuse just so that if someday there is a broker missed due to EA from one of his clients that generate huge profits then the broker can freely swing kale without paying:)

Another thing that is prohibited is the use of EA Arbitrage.

Arbitrage technique is a technique that utilizes differences in the lag time data feeds on the 2 pieces of different brokers. For example on a broker, the price has gone up 2 pips in 3 seconds ago. While at broker B this has not happened. This time lag is used, so there is a price difference is detected, then the EA will perform the entry buy at broker B by sticking that prices will go up 2 pips as it has happened to broker A.

Now let us think together, if it comes to lag time, this is one of our brokers or wrong? Surely one broker, one of its own data and realtime feednya not the same as other brokers. Consequently it can not be blamed dong if it is used by traders:)

Brokers like this usually is a broker who wants to win themselves. Prefer that his client suffered loss, but when his client would seek a profit to pay with evasive pretexts and shields these rules unreasonable.

"As long as your EAs has a logical cores" is a mantra to avoid liability. EA makes any profit clients and is considered detrimental to the broker, will be accused of not having logical cores.

After all, the determination of whether there is logical cores khan love-love the broker, if deemed not profitable, if EA was considered to exist only loss of his logical cores:)

That makes no sense regulations are generally diversified market maker broker. Understandably, the client gains are losses due to broker a broker shall pay such benefits from his own pocket. So that they will do everything possible including making unreasonable regulations as one way to circumvent the obligation to pay.

One example is where khabarnya FxPro Megadroid prohibit the use of EA for no apparent reason. Probably because EA is capable of producing consistent profits, and eventually banned from use due to be considered detrimental to the broker.

Therefore, before determining the brokers who want to use, thoroughly well what the rules of the broker. Avoid brokers who make the rules-fetched and unreasonable. Better careful from the beginning rather than later is already happy because it managed to gain profit, but the broker does not pay on the pretext that does not make sense.

Explanation of the above at once to answer the question Mr. Fitra of Lombok.

It's just that I need to straighten, the broker is not divided between small brokers and big brokers. But that is divided into two types of market makers or STP / ECN.

Instead of the broker whose name is often plastered on the internet and are often heard by Mr. Fitra, generally diversified market maker. Brokers STP / ECN is smaller brokers whose names may be unfamiliar to Mr. Fitra, like GoMarkets, FinFX, VantageFX, Pepperstone, ATC Brokers, etc..

Although brokers STP / ECN is small, but they are more honest and more transparent than the large brokerage market maker type. Market maker can be a great quick profit because they are more than STP / ECN. Market makers in addition to income from the spread, also earn revenue from the amount of loss experienced by his clients due to subterfuge carried out by the broker.

As for answering the questions Mr Acep, how do I pay when all traders brokers are professional and get a fantastic profit. The answers to these questions have been written in the article: About Brokers

If the market maker to use stop losses as described in the article About Broker above, then the broker will not have experienced a bankruptcy despite all the traders gain profit. At most, only a little loss, because the pay is the bank's future.

However, if the broker does not have stop losses due to not cooperate with the bank, it will immediately go bankrupt if there is one trader makes profit indrafxscalping phenomenal as above.

Back to the discussion of forex legend, the tendency of people who see the fantastic profits are asking "what indicators are used?". This was to be expected, as well as comments given by Mr. Robi Puguh Santoso on this blog that asks "what indicators Pake NewSystemTest who pack it?"

It has been repeatedly described in previous articles, you should never expect any indicator of "magic".

Obtaining fantastic profit is not gained by just relying on one or several pieces of indicators "magic", but rather relies on the ability of comprehensive analysis. Candlestick patterns, behavioral indicators, the trend of flat condition / ranging / trending or retrace, support resistant, and various other things. A total combined into one and then used as the basis for entry exit.

When the market flats / ranging, then take a big profit is not necessary, just a few pips only and immediately exit to survive the sudden reversal. When trending, then the profit can reach tens pip move fast because the trend in one direction only. When one entry (any seprofessional still will make mistakes like this, his name is also prediction:)), do cutloss while still a small amount of loss. Just simple things like that done.

However, although simple, necessary learning process for many years to be able to conduct a comprehensive analysis and then get a "feel" it.

Do not ever dreamed of indicators of "magic". Because the truth is that "magic" is not an indicator or trading system was, but tradernya the "magic":)

Therefore, wrought myself to one day can be a "magic"

Had not imagined how great the potential forex trading, so do not be lazy to forge ourselves. Who knew that one day God finally blessed and become rich suddenly like indrafxscalping that in just seven hours only produces the equivalent of 130 billion rupiah.

How do I get a big profit?

The key lies in the accuracy. When an accuracy better then the use of the lot is not a problem and do not need to bother anymore with money management. Just use lots of capital as much as possible until no longer sufficient, yet surely profit:)

Like indrafxscalping, for 7 hours to 340 entries and only 3 entries are experiencing loss, its accuracy is almost 100%. 130 billion rupiah profit obtained from the use of lots that continues to expand continuously performed each time an entry, which is used only during the initial trading 0.80 lots and at the end of the enlarged up to 9386 lots (almost 10 thousand lots).

indrafxscalping where even this kind enough willing to share knowledge and strategies used for free. It's not often know the forex trading world who want to share like this, almost always closed. If as for, usually a commercial nature and are required to pay dearly.

Notice how the forex trading seminar or workshop that many ads in a letter khabar, have to pay millions of rupiah just to a few hours. Though merely taught basic trading alone but peppered with promises of paradise which is guaranteed to follow when it's fantastic capable of generating profit. When in fact, which can generate fantastic profits simply by studying 2-3 hours only:)

Here is the strategy used by indrafxscalping:

Please if you want to emulate and then make its EA.

Just do not imagine that indrafxscalping strategies can be used in all sorts of market conditions. This strategy is only suitable for use in market conditions flats / ranging. So that when used on trending the condition can cause loss.

This is why EA are generally unable to survive in the long run. Because the body is programmed in the logic of a certain market conditions. Therefore, when market conditions change, then the EA is not able to perform adaptation and the resulting loss. Manual trading has more adaptability, like any market condition throughout tradernya "magic" then trading can be done well.

The examples above show that any amount can be generated from forex trading, so hopefully this article can make the reader more eager to learn trading.

No comments:

Post a Comment