After a week of doing forward test, proved that the robot MDP version 1.1.0 and version 2.1.2 can do a good entry and exit and the last week concern that the robot is not able to perform entry is proven wrong.

In version 2.1.2 because of that concerns is a bit "forced" to make entry in last week. Setting the version 2.1.2 was changed to be more aggressive. Ultimately proved to entry exit can be done well but the results are bad :(

1.1.0 MDP aggressiveness setting is located on the parameters Mode_Safe and Mode_HighSpeed. While the MDP 2.1.2 aggressiveness setting lies in the parameter ScalpFactor and VolatilityLimit.

It is known from the 2.1.2 version manual guide as shown below:

For this week will be re-forward test using four different settings as shown above. Forward test will be conducted for 4 MDP 1.1.0 EAs and 4 MDP 2.1.2 EAs using variety settings.

Forward test results for these robots can be monitored in real time at this address: ea.Andromeda-Trading.com

Journey creating profitable forex robot

It doesn't matter how slowly I go, as long as I don't stop and always do with all of my heart

The greatest weakness lies in giving up, but certain way to succeed is always to try just one more time

Monday, November 21, 2011

Elite EA Forward Test #2

As promised last week, this week carried forward test against 11 EA obtained from the pay-Forex-TSD forum Advanced Elite Section.

Yet the EA are available at Forex-TSD carried forward test, still a small part. EA carried forward test the EA-EA was previously tested by Forex-TSD and proven to generate consistent profits as shown in the figure below:

EA is currently carried forward test is marked with red color.

Forward test results for these robots can be monitored in real time at this address: ea.Andromeda-Trading.com

Yet the EA are available at Forex-TSD carried forward test, still a small part. EA carried forward test the EA-EA was previously tested by Forex-TSD and proven to generate consistent profits as shown in the figure below:

EA is currently carried forward test is marked with red color.

Forward test results for these robots can be monitored in real time at this address: ea.Andromeda-Trading.com

Wednesday, November 16, 2011

Broker News - IBFX

IBFX broker as of the date of 16 November 2011 yesterday formally acquired by TradeStation. Within a maximum of one month then the whole operation will be replaced by TradeStation IBFX.

TradeStation is known other than as a maker of trading software platforms (such as Metatrader), also known as a stock broker, Options, Futures, and Forex. IBFX acquisition is to expand outreach to the forex market where TradeStation been more focused on the stock market, Options, and Futures.

Later the client IBFX besides given the option to keep using MetaTrader, also given the option to try the software Tradestation. The hope by doing acquisitions IBFX then TradeStation software increasingly known that one moment can fully replace the Metatrader.

Here are excerpts from the statement of the Director of TradeStation:

"This is a win-win for IBFX and TradeStation clients and makes TradeStation a global leader in forex trading, dramatically expanding our customer relationships and creating a global operating presence," said Gary Weiss, President of TradeStation Forex, Inc.

Um, "a win-win for clients"? Wait a minute ... :)

At IBFX Corporate Blog is expressed as follows:

"within the next 30 days TradeStation Forex, Inc. will become the counterparty to your forex trades"

In IBFX Corporate Blog stated clearly that TradeStation will become a counterparty of the trading done by his client. This means that the client will be trading against the broker itself - TradeStation.

Like the ant against an elephant:)

From that statement is very clear that IBFX will remain a market maker type broker, it's just using a new way with TradeStation style:)

TradeStation is known other than as a maker of trading software platforms (such as Metatrader), also known as a stock broker, Options, Futures, and Forex. IBFX acquisition is to expand outreach to the forex market where TradeStation been more focused on the stock market, Options, and Futures.

Later the client IBFX besides given the option to keep using MetaTrader, also given the option to try the software Tradestation. The hope by doing acquisitions IBFX then TradeStation software increasingly known that one moment can fully replace the Metatrader.

Here are excerpts from the statement of the Director of TradeStation:

"This is a win-win for IBFX and TradeStation clients and makes TradeStation a global leader in forex trading, dramatically expanding our customer relationships and creating a global operating presence," said Gary Weiss, President of TradeStation Forex, Inc.

Um, "a win-win for clients"? Wait a minute ... :)

At IBFX Corporate Blog is expressed as follows:

"within the next 30 days TradeStation Forex, Inc. will become the counterparty to your forex trades"

In IBFX Corporate Blog stated clearly that TradeStation will become a counterparty of the trading done by his client. This means that the client will be trading against the broker itself - TradeStation.

Like the ant against an elephant:)

From that statement is very clear that IBFX will remain a market maker type broker, it's just using a new way with TradeStation style:)

Monday, November 14, 2011

DrawDown

Drawdown is a term well known in the manufacture of robots forex (Forex Expert Advisor), since this term will be displayed in backtest results.

Unfortunately, the explanation regarding the drawdown is very minimal, even on the website and forums Metatrader maker though.

Only an article that discussed , it was the basis of the discussion is still using the old version of Metatrader where the only known Max Drawdown term only, while the Relative Drawdown unknown .

Note the backtest results above, which contained only Max Drawdown only. While Relative Drawdown, which is known in the current version of MetaTrader backtest, no.

In the backtest results, there is always a third value that is Absolute drawdown Drawdown, Max Drawdown, and Relative Drawdown.

Drawdown values that measure the level of risk is a robot. The higher the value of drawdown, the more risky the robot.

Drawdown Absolute value is the amount of loss that takes capital.

For example, the first time you run the robot, the robot does not immediately make a profit but a loss in advance (although it will return later) so that the capital "consumed". For example, the initial capital of 10,000 and losses suffered before the robot makes a profit is 2000, then listed in Absolute Drawdown is 2000.

What is unclear is the definition as well as differences and Relative Drawdown Maximum Drawdown.

Finally, after searching everywhere do not see well, I make his own interpretation of what the intent of Relative Drawdown Maximum Drawdown and is based on an article on the website maker Metatrader.

In my opinion, Relative Drawdown is the ratio of the difference between the highest and lowest peak that occurred during the robot travels to the top of the highest profit.

In the picture above is the Arrow 1, the Arrow 2 and Arrow 3.

As shown in the figure, a decrease from the highest peak occurs at the Arrow 3, so the value of the ratio of peak difference between the highest and lowest Arrow 3 is what will be shown as Relative Drawdown on backtest results.

Previous Drawdown Relative value is the Arrow 1, but because of the Arrow 2, which later formed Drawdown Relative value is larger then replaced with a value of Relative Drawdown Arrow 2, which was then replaced again with Arrow Drawdown Relative value of 3 because its value is greater than the Arrow 2.

Maximal Drawdown indicated by Red Arrow thickness on the far right, where the highest peak value is compared with the lowest overall total.

The conclusion that can be taken, the greater the value of Maximal Drawdown, the greater the risk of the robot as it shows the highest peak and lowest overall.

That is, if the value of Max Drawdown is very large, then the possibility of loss will be higher than the profit because the robot has a very sharp decline resulting in earnings and capital can be instantaneously vanish due to the sharp decline.

While Relative Drawdown does not depict actual risk due to temporary nature which are always replaced with a subsequent decline in value is greater.

Thus, it does not matter if the value of the Relative Drawdown Maximum Drawdown along its value remains small.

A good robot should have a small value of Maximal Drawdown, the smaller the value, it means that the robot will not experience a significant decline in profits due to loss and decline each time the robot will always succeed doing recovery.

Maximal Drawdown is very important because it shows the overall decline in value, unlike the case with Relative Drawdown in which only shows the temporary decline in profits.

Based on the above ideas, let us analyze the results of robot backtest Revision 3.a. below:

Revision Robot 3.a. Absolute value 567.22 Maximal Drawdown Drawdown of 4.03% and 33.81% Relative Drawdown.

That is, the robot Revision 3.a. so run will "eat" the initial capital $ 10,000 (Initial Deposit) due to a loss of $ 567.22.

Then during a trip to the top of the highest profit (Net Profit) $ 120,217,260.38 will experience the deepest decline due to loss of about 33.81% or $ 180,224.81 (Relative Drawdown).

Overall, the robot Revision 3.a. will only decrease due to loss of 4.03% (Max Drawdown).

After understanding the backtest results above, it can be concluded that the robot Revision 3.a. This is a robot that has a minimal risk to the ability to obtain the maximum profit.

No wonder, just a week carried forward test, the performance of the robot Revision 3.a. direct shot and beat the robots previous versions:)

Unfortunately, the explanation regarding the drawdown is very minimal, even on the website and forums Metatrader maker though.

Only an article that discussed , it was the basis of the discussion is still using the old version of Metatrader where the only known Max Drawdown term only, while the Relative Drawdown unknown .

Note the backtest results above, which contained only Max Drawdown only. While Relative Drawdown, which is known in the current version of MetaTrader backtest, no.

In the backtest results, there is always a third value that is Absolute drawdown Drawdown, Max Drawdown, and Relative Drawdown.

Drawdown values that measure the level of risk is a robot. The higher the value of drawdown, the more risky the robot.

Drawdown Absolute value is the amount of loss that takes capital.

For example, the first time you run the robot, the robot does not immediately make a profit but a loss in advance (although it will return later) so that the capital "consumed". For example, the initial capital of 10,000 and losses suffered before the robot makes a profit is 2000, then listed in Absolute Drawdown is 2000.

What is unclear is the definition as well as differences and Relative Drawdown Maximum Drawdown.

Finally, after searching everywhere do not see well, I make his own interpretation of what the intent of Relative Drawdown Maximum Drawdown and is based on an article on the website maker Metatrader.

In my opinion, Relative Drawdown is the ratio of the difference between the highest and lowest peak that occurred during the robot travels to the top of the highest profit.

In the picture above is the Arrow 1, the Arrow 2 and Arrow 3.

As shown in the figure, a decrease from the highest peak occurs at the Arrow 3, so the value of the ratio of peak difference between the highest and lowest Arrow 3 is what will be shown as Relative Drawdown on backtest results.

Previous Drawdown Relative value is the Arrow 1, but because of the Arrow 2, which later formed Drawdown Relative value is larger then replaced with a value of Relative Drawdown Arrow 2, which was then replaced again with Arrow Drawdown Relative value of 3 because its value is greater than the Arrow 2.

Maximal Drawdown indicated by Red Arrow thickness on the far right, where the highest peak value is compared with the lowest overall total.

The conclusion that can be taken, the greater the value of Maximal Drawdown, the greater the risk of the robot as it shows the highest peak and lowest overall.

That is, if the value of Max Drawdown is very large, then the possibility of loss will be higher than the profit because the robot has a very sharp decline resulting in earnings and capital can be instantaneously vanish due to the sharp decline.

While Relative Drawdown does not depict actual risk due to temporary nature which are always replaced with a subsequent decline in value is greater.

Thus, it does not matter if the value of the Relative Drawdown Maximum Drawdown along its value remains small.

A good robot should have a small value of Maximal Drawdown, the smaller the value, it means that the robot will not experience a significant decline in profits due to loss and decline each time the robot will always succeed doing recovery.

Maximal Drawdown is very important because it shows the overall decline in value, unlike the case with Relative Drawdown in which only shows the temporary decline in profits.

Based on the above ideas, let us analyze the results of robot backtest Revision 3.a. below:

Revision Robot 3.a. Absolute value 567.22 Maximal Drawdown Drawdown of 4.03% and 33.81% Relative Drawdown.

That is, the robot Revision 3.a. so run will "eat" the initial capital $ 10,000 (Initial Deposit) due to a loss of $ 567.22.

Then during a trip to the top of the highest profit (Net Profit) $ 120,217,260.38 will experience the deepest decline due to loss of about 33.81% or $ 180,224.81 (Relative Drawdown).

Overall, the robot Revision 3.a. will only decrease due to loss of 4.03% (Max Drawdown).

After understanding the backtest results above, it can be concluded that the robot Revision 3.a. This is a robot that has a minimal risk to the ability to obtain the maximum profit.

No wonder, just a week carried forward test, the performance of the robot Revision 3.a. direct shot and beat the robots previous versions:)

How to Big Profit?

Observing various trading contest is very exciting for me. Besides trading can learn the correct way of champions, can also see how much potential the forex trading.

Observations so far indicate that, on average, who won the contest are those who are able to generate profits between 15 to 20 times a month. The highest record ever achieved is 40 times profit in a month and this only happens once just for me to observe a variety of trading contest in recent years.

But profit 40 times is a very rare, on average, who won the contests are only capable of 15-20 times a month profit trading.

Not only you are amazed with the acquisition of profit by it, I was too:)

Bagaimananya ya do? Indicators of what it is used? How it could profit by it? Those questions that always crossed my mind and I'm sure your course is the same as well:)

Taste-it seems to me unlikely this can be achieved. Especially during these trying trading result was always muddy and messy, how possibly could profit by it? No need 15-20 times, 1-2 times as much just enough hard as hell.

When you browse the various forums that exist on the Internet, the acquisition of profit more than 1 fold (or 100%) in a month is a fantastic thing. Most are located in the forum or that offer managed account services is able to generate profits between 5% to 30% in a month. That alone is quite remarkable and has been regarded as a great trader.

I have never met in any forum there are a trader who revealed that he was able to produce over 10-fold within a month. Information about this does not exist anywhere. Champions contest was always silent when asked how they could profit by it.

Well, how could profit by it if there is no any information? Confused is not it?

Begin I thought to myself, surely the champions are using an indicator of a "very powerful":) It might profit by it if not using a precision indicator

Finally began the hunt for the indicator "magic", all the indicators that are available on the internet do download and trial. However, after nearly 5,000 (five thousand!:)) Custom indicators tested, only then realizing that no single indicator of the precision and the "magic".

Desperate and confused, started to hit, how?

Until one day I read in a forum (forget which) which states:

"There is only 1 indicator in this world which will make perfect trading, look in the mirror and you will see it"

Who realize that the sentence is not the indicator of "magic" to make a major trading profitable, but how to market myself to understand the behavior and use of existing indicators.

Chart is actually a complicated puzzle, only one way to beat that train the brain, eyes and hands (for a mouse click:)) to solve the puzzles. How to do it? Brainwashing by looking at the chart again and again until eventually it slowly pattern that existed at the start seemingly puzzle.

Paradigm is tantamount to the question "Why Tiger Woods could be the golf championship when used the same stick with which we use?". Not because of his golf stick more "magic", but because he understood exactly how to use the stick.

Do not expect an understanding of market behavior or golf stick or indicator can be obtained only in a few months. It took me years to understand it. Therefore, in trading, trading experience under 5 years are still regarded as a newbie or just learning.

Therefore, if your trading experience is still below 5 years and still continued loss, chill out and should never despair because it is a reasonable proficiency level:)

Instil confidence remains in my heart that someday all try and be able to persevere through failure, the light will illuminate your mind and eventually be able to read the behavior of market

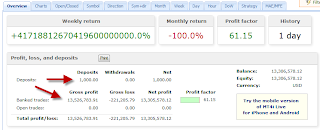

Here are the results of trials in demo trading this week:

Extraordinary is not it?

But actually no, there are many errors that occur. Entry exit is sometimes still too fast or too slow, no discipline with stop losses, misread the direction of the trend but luck finally be able to profit, and so forth. Still need more practice more so that the mistakes that occurred more minimal.

The next question that arises is usually a "powerful indicator of what is used"?

Naturally, because I always wondered was like that too:)

Who used only standard indicators. From the beginning I always liked to learn trading Stochastic, for some reason, perhaps because it uses two lines making it easier to read. Another indicator used is the MACD, Bollinger, and several lines Moving Average. Just that alone is used.

Conclusions obtained during trading, sometimes misleading indicator because it shows the wrong direction. That saves only the understanding of market behavior.

When you see the market trading as anticipated, you already know what to do.

Understanding of market behavior causes the direction of the trend is looming in the head, the direction now, where will the next. Therefore, when the indicator shows the direction that is misleading, will remain safe because the image of the existing market patterns in the head.

Chart was originally like a complicated puzzle, but once understood it will be known behavior pattern. These capabilities are owned by the contest champions, not because of the indicator "magic".

However, it should be understood that the trading system is a common indicator is personal. That is, do not continue because I use Stochatic then you follow it too. All indicators are the same, if you prefer to use MACD as a leading indicator, so use it alone.

Express your personality trading system, use it to suit your own personality and should never force myself to use that is not liked or understood.

I myself do not get along and do not like long term trading (except under conditions that take a long time trending). It was also just I know. Trading performance I did even better when trading using scalping, and out in no time.

For me, good trading is a way to minimize the risk was or was not to expose too long in the market. However, no one can predict the market accurately. With in and out in no time, then the market risk of a sudden U-turn can be further minimized.

In addition, longterm trading for me is very boring:) More comfortable in and out quickly because it requires constant concentration. Mathematical calculation is more profitable than the long term because scalping entry was swift exit when a reversal is taking place.

Instead of letting long term continuous wide-open entry in a long time and follow the retrace to the end profit targets can be achieved. The problem, if the alleged merely retrace but then it turns out that there is a trend reversal, then yes definitely, because the original entry will turn profit into loss:)

Therefore, find the right trading system according to the personality of each. Every person is different character, will surely have a different way as well.

Find out how it and never listen to others' opinions.

Trading is a personal, depending on the mindset and worldview each of which is by yourself is true. Let others argue the other, but still hold on to the way you have your own.

What if the means used was wrong?

Easy, you will understand by itself later on, because time will prove one point. And when that happens, then your perception will change by itself to abandon a wrong and then find the right one.

However, always make sure that the way it will survive and continuously profitable in the long run. Way of trading that can survive long term is still trading with risk measured but the result is maximum, not vice versa.

Professional traders instead of looking at profit, but tend to look at risk. In contrast to the layman, profitlah the objectives. Familiarize yourself to be able to measure risks, eventually profits will automatically follow. If trading is only profit-oriented, does not measure risk, and coupled with a blind way, then the name is not trading, but gambling:)

Gambling fully rely on luck, could have obtained profit. But just try doing something like that a few months, of course, luck will not always follow:)

As noted above, the time that would later prove.

In trading, the belief in yourself is very important. Therefore you should never listen to others' opinions. Analyze and decide for yourself, even if later one but you will learn from those mistakes.

Let us consider together how great the potential of forex trading below:

Each day can produce 141% profit, and if this performance continues and never experienced loss in a month then the profit is estimated to reach 40 times or 4019%. Although it was once at the beginning of the trading loss that occurs 56% drawdown, but able to recover and produce a 709% profit in a trading week.

Well, it could quickly become billionaires about this:)

Look how big the potential forex, capital of five thousand a week can be converted to 40 thousand. But to do things like this entry-exit capability required very accurate.

Due to such a large profit, use a large number of lots as well, which if it turns out one entry exit then the consequences would be fatal, capital and profits obtained before will instantly disappear instantly. Surely in a live trading using money truth, something like this should be avoided because the risk is very high.

Forex is not a quick way to get rich, but gradually will become rich. The principle of trading is right is coumpounding, gathering little by little over time into a hill.

Imagine if the trading week with a capital of 5000 and each week could result in 1-2 fold alone is more than enough. Imagine if every week can produce 50-10 thousand dollars, or about 45 million to 90 million rupiah, then the director's salary in a month was lost:)

Tube just a little profit and use for their daily needs, of course 1-2 years later you will become rich. Rather than forcing trading to achieve 20-fold, and so there is only one entry only once, the entire capital and profits vanish instantly.

The main principle of trading is compounding, which can be obtained only by a consistent manner that is capable of continuous profit in the long run. Acquired skills by practicing in advance consistency in the demo, and then move to live trading when it proved to be consistent.

Do not ever think demos and live differently, both are the same. So if you have not been able to consistently profit in the demo, it was clear in the live trading will be more severe. Live trading is more demanding because of the emotional maturity of psychological pressure and stress levels are higher due to the realization that the money used is truth.

More efficient practice on a demo earlier than force myself live trading.

Hopefully this can remove the curiosity of how to contest champions earn a fantastic profit.

Observations so far indicate that, on average, who won the contest are those who are able to generate profits between 15 to 20 times a month. The highest record ever achieved is 40 times profit in a month and this only happens once just for me to observe a variety of trading contest in recent years.

But profit 40 times is a very rare, on average, who won the contests are only capable of 15-20 times a month profit trading.

Not only you are amazed with the acquisition of profit by it, I was too:)

Bagaimananya ya do? Indicators of what it is used? How it could profit by it? Those questions that always crossed my mind and I'm sure your course is the same as well:)

Taste-it seems to me unlikely this can be achieved. Especially during these trying trading result was always muddy and messy, how possibly could profit by it? No need 15-20 times, 1-2 times as much just enough hard as hell.

When you browse the various forums that exist on the Internet, the acquisition of profit more than 1 fold (or 100%) in a month is a fantastic thing. Most are located in the forum or that offer managed account services is able to generate profits between 5% to 30% in a month. That alone is quite remarkable and has been regarded as a great trader.

I have never met in any forum there are a trader who revealed that he was able to produce over 10-fold within a month. Information about this does not exist anywhere. Champions contest was always silent when asked how they could profit by it.

Well, how could profit by it if there is no any information? Confused is not it?

Begin I thought to myself, surely the champions are using an indicator of a "very powerful":) It might profit by it if not using a precision indicator

Finally began the hunt for the indicator "magic", all the indicators that are available on the internet do download and trial. However, after nearly 5,000 (five thousand!:)) Custom indicators tested, only then realizing that no single indicator of the precision and the "magic".

Desperate and confused, started to hit, how?

Until one day I read in a forum (forget which) which states:

"There is only 1 indicator in this world which will make perfect trading, look in the mirror and you will see it"

Who realize that the sentence is not the indicator of "magic" to make a major trading profitable, but how to market myself to understand the behavior and use of existing indicators.

Chart is actually a complicated puzzle, only one way to beat that train the brain, eyes and hands (for a mouse click:)) to solve the puzzles. How to do it? Brainwashing by looking at the chart again and again until eventually it slowly pattern that existed at the start seemingly puzzle.

Paradigm is tantamount to the question "Why Tiger Woods could be the golf championship when used the same stick with which we use?". Not because of his golf stick more "magic", but because he understood exactly how to use the stick.

Do not expect an understanding of market behavior or golf stick or indicator can be obtained only in a few months. It took me years to understand it. Therefore, in trading, trading experience under 5 years are still regarded as a newbie or just learning.

Therefore, if your trading experience is still below 5 years and still continued loss, chill out and should never despair because it is a reasonable proficiency level:)

Instil confidence remains in my heart that someday all try and be able to persevere through failure, the light will illuminate your mind and eventually be able to read the behavior of market

Here are the results of trials in demo trading this week:

Extraordinary is not it?

But actually no, there are many errors that occur. Entry exit is sometimes still too fast or too slow, no discipline with stop losses, misread the direction of the trend but luck finally be able to profit, and so forth. Still need more practice more so that the mistakes that occurred more minimal.

The next question that arises is usually a "powerful indicator of what is used"?

Naturally, because I always wondered was like that too:)

Who used only standard indicators. From the beginning I always liked to learn trading Stochastic, for some reason, perhaps because it uses two lines making it easier to read. Another indicator used is the MACD, Bollinger, and several lines Moving Average. Just that alone is used.

Conclusions obtained during trading, sometimes misleading indicator because it shows the wrong direction. That saves only the understanding of market behavior.

When you see the market trading as anticipated, you already know what to do.

Understanding of market behavior causes the direction of the trend is looming in the head, the direction now, where will the next. Therefore, when the indicator shows the direction that is misleading, will remain safe because the image of the existing market patterns in the head.

Chart was originally like a complicated puzzle, but once understood it will be known behavior pattern. These capabilities are owned by the contest champions, not because of the indicator "magic".

However, it should be understood that the trading system is a common indicator is personal. That is, do not continue because I use Stochatic then you follow it too. All indicators are the same, if you prefer to use MACD as a leading indicator, so use it alone.

Express your personality trading system, use it to suit your own personality and should never force myself to use that is not liked or understood.

I myself do not get along and do not like long term trading (except under conditions that take a long time trending). It was also just I know. Trading performance I did even better when trading using scalping, and out in no time.

For me, good trading is a way to minimize the risk was or was not to expose too long in the market. However, no one can predict the market accurately. With in and out in no time, then the market risk of a sudden U-turn can be further minimized.

In addition, longterm trading for me is very boring:) More comfortable in and out quickly because it requires constant concentration. Mathematical calculation is more profitable than the long term because scalping entry was swift exit when a reversal is taking place.

Instead of letting long term continuous wide-open entry in a long time and follow the retrace to the end profit targets can be achieved. The problem, if the alleged merely retrace but then it turns out that there is a trend reversal, then yes definitely, because the original entry will turn profit into loss:)

Therefore, find the right trading system according to the personality of each. Every person is different character, will surely have a different way as well.

Find out how it and never listen to others' opinions.

Trading is a personal, depending on the mindset and worldview each of which is by yourself is true. Let others argue the other, but still hold on to the way you have your own.

What if the means used was wrong?

Easy, you will understand by itself later on, because time will prove one point. And when that happens, then your perception will change by itself to abandon a wrong and then find the right one.

However, always make sure that the way it will survive and continuously profitable in the long run. Way of trading that can survive long term is still trading with risk measured but the result is maximum, not vice versa.

Professional traders instead of looking at profit, but tend to look at risk. In contrast to the layman, profitlah the objectives. Familiarize yourself to be able to measure risks, eventually profits will automatically follow. If trading is only profit-oriented, does not measure risk, and coupled with a blind way, then the name is not trading, but gambling:)

Gambling fully rely on luck, could have obtained profit. But just try doing something like that a few months, of course, luck will not always follow:)

As noted above, the time that would later prove.

In trading, the belief in yourself is very important. Therefore you should never listen to others' opinions. Analyze and decide for yourself, even if later one but you will learn from those mistakes.

"Keep your own counsel, avoid gurus.

Jesse Livermore viewed trading as a "lone-wolf" business, and it is.

Learn to read the market and make your own decisions."

Five Trading "Don’ts" and What to Do About Them

Let us consider together how great the potential of forex trading below:

Each day can produce 141% profit, and if this performance continues and never experienced loss in a month then the profit is estimated to reach 40 times or 4019%. Although it was once at the beginning of the trading loss that occurs 56% drawdown, but able to recover and produce a 709% profit in a trading week.

Well, it could quickly become billionaires about this:)

Look how big the potential forex, capital of five thousand a week can be converted to 40 thousand. But to do things like this entry-exit capability required very accurate.

Due to such a large profit, use a large number of lots as well, which if it turns out one entry exit then the consequences would be fatal, capital and profits obtained before will instantly disappear instantly. Surely in a live trading using money truth, something like this should be avoided because the risk is very high.

Forex is not a quick way to get rich, but gradually will become rich. The principle of trading is right is coumpounding, gathering little by little over time into a hill.

Imagine if the trading week with a capital of 5000 and each week could result in 1-2 fold alone is more than enough. Imagine if every week can produce 50-10 thousand dollars, or about 45 million to 90 million rupiah, then the director's salary in a month was lost:)

Tube just a little profit and use for their daily needs, of course 1-2 years later you will become rich. Rather than forcing trading to achieve 20-fold, and so there is only one entry only once, the entire capital and profits vanish instantly.

The main principle of trading is compounding, which can be obtained only by a consistent manner that is capable of continuous profit in the long run. Acquired skills by practicing in advance consistency in the demo, and then move to live trading when it proved to be consistent.

Do not ever think demos and live differently, both are the same. So if you have not been able to consistently profit in the demo, it was clear in the live trading will be more severe. Live trading is more demanding because of the emotional maturity of psychological pressure and stress levels are higher due to the realization that the money used is truth.

More efficient practice on a demo earlier than force myself live trading.

Hopefully this can remove the curiosity of how to contest champions earn a fantastic profit.

Brokers Tricks #2

A month ago Forex.com demo server to crash in which to make entry, exit, change the value or takeprofit stop losses can not be done.

Here is a picture when the server is experiencing an error:

Seen in the picture above, stop losses did not work. Entry experienced loss and are not close automatically by the server. Note also the trade window, the value of stop losses are colored yellow, indicating that the stop losses are not working.

It is extremely rare, for many years using a new demo this time I experienced it.

But do not think this only happens on the demo server only. It is precisely on live servers this is very common, especially in the manifold Market Maker broker (the broker about the types of articles can be read at: Market Maker & ECN Brokers ).

On the live servers this condition usually occurs when high-impact news announcement. At that time, the Metatrader client terminal will be in the "freeze" by the broker so that clients can not do anything.

If you just freeze it does not matter, but generally the broker also commit fraud by making delay to stop losses (as exemplified above picture). STOP LOSS is made does not work some of the old and new active again after a complete high-impact news reported.

Eg entry with a stop loss 30 pips, if the news impacts resulted in the movement of 100 pips against the entry, then do not expect the entry of his only loss of 30 pips. The new work when it reaches the stop losses 100 pips or 120 pips, so that there is a loss of 100 pips and not only 30 pips.

This incident I have ever experienced, then I do live chat technical support and complain to the broker. They reasoned that because the price movements caused by news very quickly, then the server becomes too late mengantipasinya. The new stop losses work after price movements become normal again (meaning the new normal in 100 pips).

I believe that time alone, knowing new to forex. It's just a question mark still arises, how come so late to the server?

Please note that once the entry is done then the value of stop losses and takeprofit no longer stored on the client computer, but stored on the server broker. So that when a client computer off or an internet connection is lost, then the order will still be safe because it is automatically handled by the server broker.

When should an order to stop losses at the close, then the order will be closed in a state of loss and vice versa if the value takeprofit touched, then the order will be closed in profit condition.

Therefore, make it a habit to put stop losses and takeprofit value at the time of entry. This is a precaution if the electricity or the internet dies, the order will remain secure because the server automatically handled by the broker.

Especially the value of stop losses that must be prioritized to be determined from the beginning, this is to avoid disruption in the event of connection and direction of the trend as opposed to fixed capital entry then congratulations because the order will automatically close when hit stop losses.

Back to delay processing the stop losses. how come so late to process something that is already stored on the server?

The delay should not occur. If the stop losses are in the client computer, of course, is understandable in case of inaction, perhaps because the internet connection is not good, probably because of power failure, or other causes.

Well, stop losses value is already stored on the server, but why is it still too late? This question is very disturbing, because it is logically impossible.

Jawavab finally found after discovery of software called Virtual Dealer Plug-ins, as the article ever written on Brokers Tricks .

Software is exactly what did happen to delay. With the delay in the process then the client will experience a larger loss than it should be so that the broker will be benefited.

Therefore, be alert if the order does not close automatically when the value passes and stop losses are colored yellow like the picture above. If this happens to you, immediately moving broker. It's clear that brokers commit fraud with the help of software Virtual Dealer Plugin.

Almost the entire Market Maker brokers tend to do so. This is because the loss that you experience is a benefit broker. The more you experience loss, then the broker will be more benefited.

Immediately move to broker a manifold STP or ECN (GoMarkets, Vantage FX, etc.) that are safer and more certain.

Here is a picture when the server is experiencing an error:

Seen in the picture above, stop losses did not work. Entry experienced loss and are not close automatically by the server. Note also the trade window, the value of stop losses are colored yellow, indicating that the stop losses are not working.

It is extremely rare, for many years using a new demo this time I experienced it.

But do not think this only happens on the demo server only. It is precisely on live servers this is very common, especially in the manifold Market Maker broker (the broker about the types of articles can be read at: Market Maker & ECN Brokers ).

On the live servers this condition usually occurs when high-impact news announcement. At that time, the Metatrader client terminal will be in the "freeze" by the broker so that clients can not do anything.

If you just freeze it does not matter, but generally the broker also commit fraud by making delay to stop losses (as exemplified above picture). STOP LOSS is made does not work some of the old and new active again after a complete high-impact news reported.

Eg entry with a stop loss 30 pips, if the news impacts resulted in the movement of 100 pips against the entry, then do not expect the entry of his only loss of 30 pips. The new work when it reaches the stop losses 100 pips or 120 pips, so that there is a loss of 100 pips and not only 30 pips.

This incident I have ever experienced, then I do live chat technical support and complain to the broker. They reasoned that because the price movements caused by news very quickly, then the server becomes too late mengantipasinya. The new stop losses work after price movements become normal again (meaning the new normal in 100 pips).

I believe that time alone, knowing new to forex. It's just a question mark still arises, how come so late to the server?

Please note that once the entry is done then the value of stop losses and takeprofit no longer stored on the client computer, but stored on the server broker. So that when a client computer off or an internet connection is lost, then the order will still be safe because it is automatically handled by the server broker.

When should an order to stop losses at the close, then the order will be closed in a state of loss and vice versa if the value takeprofit touched, then the order will be closed in profit condition.

Therefore, make it a habit to put stop losses and takeprofit value at the time of entry. This is a precaution if the electricity or the internet dies, the order will remain secure because the server automatically handled by the broker.

Especially the value of stop losses that must be prioritized to be determined from the beginning, this is to avoid disruption in the event of connection and direction of the trend as opposed to fixed capital entry then congratulations because the order will automatically close when hit stop losses.

Back to delay processing the stop losses. how come so late to process something that is already stored on the server?

The delay should not occur. If the stop losses are in the client computer, of course, is understandable in case of inaction, perhaps because the internet connection is not good, probably because of power failure, or other causes.

Well, stop losses value is already stored on the server, but why is it still too late? This question is very disturbing, because it is logically impossible.

Jawavab finally found after discovery of software called Virtual Dealer Plug-ins, as the article ever written on Brokers Tricks .

Software is exactly what did happen to delay. With the delay in the process then the client will experience a larger loss than it should be so that the broker will be benefited.

Therefore, be alert if the order does not close automatically when the value passes and stop losses are colored yellow like the picture above. If this happens to you, immediately moving broker. It's clear that brokers commit fraud with the help of software Virtual Dealer Plugin.

Almost the entire Market Maker brokers tend to do so. This is because the loss that you experience is a benefit broker. The more you experience loss, then the broker will be more benefited.

Immediately move to broker a manifold STP or ECN (GoMarkets, Vantage FX, etc.) that are safer and more certain.

Brokers Tricks

At the present time, nearly 90% of forex brokers using Metatrader platform. Even the big brokers like Oanda too early this year began to switch to using Metatrader. Dukascopy who initially survived using jForex, also began to offer the Metatrader platform though still in beta stage.

Metatrader is a very popular trading platform. Easy to use, flexible as possible the custom indicators and custom scripts, can run the automatic trading (expert advisor / robots), and do not need large resources so it can run on any computer like.

But behind its simplicity, it turns out there is another side to harm the client but profitable brokers. This is actually done by the manufacturer Metatrader own in March 2006 announced the availability of an additional program (plugin) that can be purchased by the broker Metatrader platform users.

The program is intended to benefit the broker can be further increased by manipulating trading without being detected. Additional programs are called Virtual Dealer Plugin.

This plugin can do the following things:

- Delay execution, so that clients experience requotes

- Increase or decrease the spread

- Stop (freeze) terminal poada especially when news that the client can not perform any transactions

- Make the stop losses are not effective, so loss becomes larger

- And many other things that benefit the broker but is detrimental to the client

Remarkably, all this happens automatically, brokers do not bother doing it manually, the plugin will handle everything with an automatic. Clients are made to experience loss, so the money went into the hands of brokers. Clients are not made aware that the loss was due to a trick so difficult to prove and prosecution.

One example that often occurs is the spike in prices suddenly (spike) as shown in the figure below:

Spike is a natural thing happens in forex which is usually due to the fundamental news release.

But when the spike occurs in the absence of news, then it deserves to be suspected. An easy way to detect whether the spike is a natural thing, compare it with another broker. If another broker does not show the same spike, then immediately move a broker because the broker is obvious manipulation.

The other thing is sometimes done brokers make the price movement chart its own so different from other brokers as shown in the figure below:

Visible in the image above that there is a difference of price movement. Only use a broker that has the same price movement with other brokers. Brokers who do their own price movements are usually a scam brokers, as had previously been written on the article Forex broker .

Increase or decrease the spread is very easily done by the broker, as shown in the figure below:

From the figure above shows that the GBPUSD has spread 111.4 pip and USDCHF 101.3 pip, but usually spreads are both only about 3-4 pips. Note the bid and ask distance lines (red lines and gray) is so far proving that the value spread is very large, up-to pass a few candles.

The following figure shows such as what if the transaction has been done before spreads enlarge:

Surely, if entry made before spreads widened and given a value of stop losses, could have affected the value of stop losses are spread so that the enlargement of experience loss. But if the entry done at the time spread has enlarged, imagine how hard it is to obtain profit because they have to close the spread of such magnitude.

If you currently still have not been consistent profit and loss, the things above are not much to worry about. However, if it has managed to consistently profit for at least 2 consecutive months, then yours will live acccount automatically entered into the watch list broker.

Keep in mind, when used is Market Maker or Dealing Desk broker then your profit is actually earned the money belongs to the broker. So the broker will do everything possible to secure himself and make trading conditions in order conducted endeavored that loss. If you do not understand the kinds of brokers, please read it here: Market Maker & ECN Brokers

Therefore, as indicated capable of consistent profits for at least 2 months broker will automatically enter your account number into the watch list. The goal for accounts that are in the watch list is made to the possibility to get the profit will be lower.

Virtual Dealer Plugin program will run only for special accounts that are on watch lists. Requotes will often occur, sudden spike occurs, the spread is suddenly enlarged, stop losses are not functioning, and various other things that are experienced not profit, but loss continuously.

Below is the experience of an experienced trader who previously managed to profit after a few months:

Although the article mentioned above is clearly the name of a broker who commit fraud, but actually a trick like this is not limited only to the broker. The entire Market Maker broker who is or Dealing Desk brokers will tend to commit fraud to secure his own.

Um, not imagined how difficult forex. Can trade well and then be able to generate profits is difficult enough, especially after it was cheated by brokers.

In conclusion, the journey to get profit from forex to go through two stages. The first stage, beat the market so as to be consistent profits. The second phase, an adventure from one broker to another broker until finally finding the right broker and did not act fraudulently.

It is theoretically good broker is an ECN type, but choosing the right was somewhat difficult because currently many brokers who promote themselves as ECN but the fact remains as Market Maker or Dealing Desk broker. ECN is only used labels for marketing purposes only so many clients are interested in, but actually is not a pure ECN broker.

Hopefully this can help many people to be more alert to the broker. Brokers move immediately when experiencing things like the above if you do not want to be harmed.

Metatrader is a very popular trading platform. Easy to use, flexible as possible the custom indicators and custom scripts, can run the automatic trading (expert advisor / robots), and do not need large resources so it can run on any computer like.

But behind its simplicity, it turns out there is another side to harm the client but profitable brokers. This is actually done by the manufacturer Metatrader own in March 2006 announced the availability of an additional program (plugin) that can be purchased by the broker Metatrader platform users.

The program is intended to benefit the broker can be further increased by manipulating trading without being detected. Additional programs are called Virtual Dealer Plugin.

This plugin can do the following things:

- Delay execution, so that clients experience requotes

- Increase or decrease the spread

- Stop (freeze) terminal poada especially when news that the client can not perform any transactions

- Make the stop losses are not effective, so loss becomes larger

- And many other things that benefit the broker but is detrimental to the client

Remarkably, all this happens automatically, brokers do not bother doing it manually, the plugin will handle everything with an automatic. Clients are made to experience loss, so the money went into the hands of brokers. Clients are not made aware that the loss was due to a trick so difficult to prove and prosecution.

One example that often occurs is the spike in prices suddenly (spike) as shown in the figure below:

Spike is a natural thing happens in forex which is usually due to the fundamental news release.

But when the spike occurs in the absence of news, then it deserves to be suspected. An easy way to detect whether the spike is a natural thing, compare it with another broker. If another broker does not show the same spike, then immediately move a broker because the broker is obvious manipulation.

The other thing is sometimes done brokers make the price movement chart its own so different from other brokers as shown in the figure below:

Visible in the image above that there is a difference of price movement. Only use a broker that has the same price movement with other brokers. Brokers who do their own price movements are usually a scam brokers, as had previously been written on the article Forex broker .

Increase or decrease the spread is very easily done by the broker, as shown in the figure below:

From the figure above shows that the GBPUSD has spread 111.4 pip and USDCHF 101.3 pip, but usually spreads are both only about 3-4 pips. Note the bid and ask distance lines (red lines and gray) is so far proving that the value spread is very large, up-to pass a few candles.

The following figure shows such as what if the transaction has been done before spreads enlarge:

Surely, if entry made before spreads widened and given a value of stop losses, could have affected the value of stop losses are spread so that the enlargement of experience loss. But if the entry done at the time spread has enlarged, imagine how hard it is to obtain profit because they have to close the spread of such magnitude.

If you currently still have not been consistent profit and loss, the things above are not much to worry about. However, if it has managed to consistently profit for at least 2 consecutive months, then yours will live acccount automatically entered into the watch list broker.

Keep in mind, when used is Market Maker or Dealing Desk broker then your profit is actually earned the money belongs to the broker. So the broker will do everything possible to secure himself and make trading conditions in order conducted endeavored that loss. If you do not understand the kinds of brokers, please read it here: Market Maker & ECN Brokers

Therefore, as indicated capable of consistent profits for at least 2 months broker will automatically enter your account number into the watch list. The goal for accounts that are in the watch list is made to the possibility to get the profit will be lower.

Virtual Dealer Plugin program will run only for special accounts that are on watch lists. Requotes will often occur, sudden spike occurs, the spread is suddenly enlarged, stop losses are not functioning, and various other things that are experienced not profit, but loss continuously.

Below is the experience of an experienced trader who previously managed to profit after a few months:

Although the article mentioned above is clearly the name of a broker who commit fraud, but actually a trick like this is not limited only to the broker. The entire Market Maker broker who is or Dealing Desk brokers will tend to commit fraud to secure his own.

Um, not imagined how difficult forex. Can trade well and then be able to generate profits is difficult enough, especially after it was cheated by brokers.

In conclusion, the journey to get profit from forex to go through two stages. The first stage, beat the market so as to be consistent profits. The second phase, an adventure from one broker to another broker until finally finding the right broker and did not act fraudulently.

It is theoretically good broker is an ECN type, but choosing the right was somewhat difficult because currently many brokers who promote themselves as ECN but the fact remains as Market Maker or Dealing Desk broker. ECN is only used labels for marketing purposes only so many clients are interested in, but actually is not a pure ECN broker.

Hopefully this can help many people to be more alert to the broker. Brokers move immediately when experiencing things like the above if you do not want to be harmed.

Comparing Brokers (#12)

This week trials comparing the broker by using multiple pairs, namely using the AUDUSD, EURUSD, GBPUSD, EURJPY, USDCAD, USDCHF, and USDJPY produced as follows:

When comparing the test last week that only uses the EURUSD produce GoMarkets and FXCBS Zero Commission as a retail brokerage account option, then for this week only GoMarkets who survived. While FXCBS ranking dropped from first rank to rank 11.

It can be concluded that FXCBS only good for EURUSD only, but once used multiple pairs, besides the EURUSD pair turned out to have higher spreads than other brokers. This is what causes FXCBS down the rankings.

The best for this week is GoMarkets and FxPro, where the broker provides both high leverage up to 1:500 and the minimum deposit required was not great.

Alpari Pro Account is not selected due to requiring a large deposit of USD 20 thousand. As with FXOpen ECN and ECN FinFX which requires a deposit USD 1000 and USD 2500. While the FX Pepperstone not chosen because of his ping above 350 ms, where it indicates that the broker server response is slow which later can result in delays execution of the transaction.

Detailed comparison trials that have been grouped according to each pair are as follows:

Comparing the above is done by using 39 data on the pair of transactions that are divided as follows:

- AUDUSD, 4 transactions

- EURUSD, 12 transactions

- GBPUSD, 8 transactions

- EURJPY, 4 transactions

- USDCAD, 4 transactions

- USDCHF, 6 transactions

- USDJPY, a transaction

Based on the results of the above comparisons, it appears that GoMarkets and FxPro very good especially on the AUDUSD, EURUSD, and GBPUSD, but very poorly on USDJPY and USDCHF. However, overall 2 retail brokers that help make the biggest profit compared to other brokers.

Keep in mind about FxPro, as ever was written on the article Comparing Brokers (# 11) , FxPro since last week banned the use of EA, especially aggressive. Therefore, if you want to use the EA in trading then it's better to avoid FxPro.

While GoMarkets can generate more profit than other brokers because the spreads are very low. This is possible because the broker is a broker STP (Straight Through Processing) as written on his website.

For the first time what it says on the website of the broker in accordance with the facts:)

In the previous article, Comparing Brokers (# 3) , written about FXDD MtXterme a minimum deposit of USD 5,000 should be promoted on its website that the spread will be much smaller. But from the fact the previous benchmarking tests results show the contrary, the spreads are very large. In this trial also showed that MtXterme and FXDD FXDD Malta ranks lowest.

FXDD, FXOpen, FxPro, Forex.com, TADAWUL, Alpari Standard Account is Dealing Desk broker, where its spread is likely to be high. Surprisingly only FxPro, although Dealing Desk broker but applying low spreads like STP or ECN broker.

For those who do not yet understand the kinds of brokers, please read the article market Maker & ECN Brokers and Brokers Type .

Simply put, Dealing Desk Brokers is a bit like dealing with Money Changer, which is to buy or sell against the owner of the Money Changer. While STP or ECN broker is much like a stock broker, that broker is only acting as a middleman, just forward sale and purchase orders to the exchange (the bank) and do not do transactions against the trader.

Next week trial will resume benchmarking which will be fully used robots (EA) in performing entry-exit. With the use of robots, consistency and accuracy expected exit timing of entry can be more awake, so the final result will also be more accurate comparisons.

When comparing the test last week that only uses the EURUSD produce GoMarkets and FXCBS Zero Commission as a retail brokerage account option, then for this week only GoMarkets who survived. While FXCBS ranking dropped from first rank to rank 11.

It can be concluded that FXCBS only good for EURUSD only, but once used multiple pairs, besides the EURUSD pair turned out to have higher spreads than other brokers. This is what causes FXCBS down the rankings.

The best for this week is GoMarkets and FxPro, where the broker provides both high leverage up to 1:500 and the minimum deposit required was not great.

Alpari Pro Account is not selected due to requiring a large deposit of USD 20 thousand. As with FXOpen ECN and ECN FinFX which requires a deposit USD 1000 and USD 2500. While the FX Pepperstone not chosen because of his ping above 350 ms, where it indicates that the broker server response is slow which later can result in delays execution of the transaction.

Detailed comparison trials that have been grouped according to each pair are as follows:

Comparing the above is done by using 39 data on the pair of transactions that are divided as follows:

- AUDUSD, 4 transactions

- EURUSD, 12 transactions

- GBPUSD, 8 transactions

- EURJPY, 4 transactions

- USDCAD, 4 transactions

- USDCHF, 6 transactions

- USDJPY, a transaction

Based on the results of the above comparisons, it appears that GoMarkets and FxPro very good especially on the AUDUSD, EURUSD, and GBPUSD, but very poorly on USDJPY and USDCHF. However, overall 2 retail brokers that help make the biggest profit compared to other brokers.

Keep in mind about FxPro, as ever was written on the article Comparing Brokers (# 11) , FxPro since last week banned the use of EA, especially aggressive. Therefore, if you want to use the EA in trading then it's better to avoid FxPro.

While GoMarkets can generate more profit than other brokers because the spreads are very low. This is possible because the broker is a broker STP (Straight Through Processing) as written on his website.

For the first time what it says on the website of the broker in accordance with the facts:)

In the previous article, Comparing Brokers (# 3) , written about FXDD MtXterme a minimum deposit of USD 5,000 should be promoted on its website that the spread will be much smaller. But from the fact the previous benchmarking tests results show the contrary, the spreads are very large. In this trial also showed that MtXterme and FXDD FXDD Malta ranks lowest.

FXDD, FXOpen, FxPro, Forex.com, TADAWUL, Alpari Standard Account is Dealing Desk broker, where its spread is likely to be high. Surprisingly only FxPro, although Dealing Desk broker but applying low spreads like STP or ECN broker.

For those who do not yet understand the kinds of brokers, please read the article market Maker & ECN Brokers and Brokers Type .

Simply put, Dealing Desk Brokers is a bit like dealing with Money Changer, which is to buy or sell against the owner of the Money Changer. While STP or ECN broker is much like a stock broker, that broker is only acting as a middleman, just forward sale and purchase orders to the exchange (the bank) and do not do transactions against the trader.

Next week trial will resume benchmarking which will be fully used robots (EA) in performing entry-exit. With the use of robots, consistency and accuracy expected exit timing of entry can be more awake, so the final result will also be more accurate comparisons.

Market Maker & ECN Broker

In stock trading, brokers act as intermediaries that connect with a market trader. Stock exchange regulations that require traders can only sell or buy shares through a broker's hand where it is done so easily exchange authority in conducting surveillance.

Stock broker will make a purchase or sale on the stock exchange in accordance with the prices that occurred at that time. Never had a stock broker, so the purchase or sale is made between the client in a different broker or brokers. It never occurred a client to buy shares from a broker, because the broker is acting as an intermediary only and not a stock trader.

Unlike in the forex, broker divided into 2 types, namely:

- Dealing Desk broker or also known as Market Maker Broker

- ECN (Electronic Communications Network) brokers

Market Maker broker is a broker that is currently the most widely encountered. They are not intermediaries like stock brokers, but act as a seller or buyer.

A simple example of such an easily understood or Bank Money Changer. You can exchange foreign currency amount to anything as you wish at the Money Changer or Bank but with the rate they've set yourself. You can not not determine its own exchange rate?

Try occasionally traveled to several Money Changer or the Bank to exchange Euro to U.S. Dollar exchange rate they charge of course vary. Though every day the official reference rate set by Bank Indonesia, but still there is a difference between the Money Changers or Banks. That difference is called spread, namely the difference between the selling and buying value.

For example, the official reference rate set for sale is a 9200 and bought the 9000. This means that if you want to sell your own property then the dollar appreciated only 9000, whereas if you do not have dollars and want to redeem the rupiah has become then have to pay 9200 dollars.

Although he has established an official reference exchange rate, but in practice or Bank Money Changer may apply its own spread, for example, selling for 9225 and bought by 8950. Therefore, applying the Bank Money Changer or spread of each there arose a difference, so if you try to get around to some or Bank Money Changer will then find that the exchange rate they charge is different. When in fact its just the same exchange rate because it has no official benchmark rate, to be different because the application of different spreads.

Such was the picture of simplicity Market Maker broker.

When used Market Maker broker then you actually buy or sell to the broker, not to the stock exchange. That is, if a profit then the actual profit is part of the money broker that you take. Conversely when experiencing loss, then the money belongs to you will go into the pockets of brokers.

When confused with the above explanation, just imagine Money Changer and not the forex broker. Because basically, Market Maker broker is really just another form of the Money Changer.

Suppose you come to the Money Changer to buy dollars at a price of 9200, of course, after you buy it you lose money dikantong 9200 and replaced with a sheet of one dollar. An hour later you come back to the Money Changer, it appeared that an increase in the exchange rate, for example to sell 9500 and buy 9300. Surely, if you belong to redeem a dollar, then it has obtained profits of 100, having previously purchased for 9200 but can now be sold at a price of 9300.

Whose money is used to pay for 100 benefit them? Of course, money Money Changer because you are trading and the place is paid.

Simply put, when used in Market Maker broker, then you actually do the trading against the broker. Because, you get the same benefits with the losses suffered by the broker.

Therefore, the broker will make efforts so that you do not get lucky, the "cripple" your account it will be more profitable for the broker:)

Here are various ways brokers can instantly create an account to "stump":)

1. Leverage

Many brokers who provide great leverage, there is a 1:500 even reached 1:1000. The beginners are generally very happy with this because quite a little capital, it will be able to buy lots in bulk. Of course, in the shadow of the head, how very efficient, with just a small capital but can generate huge profits. Whereas in the forex, profit is not easy to come by, which is easily available is the loss:)

If able to buy at once 20 lots with a capital of only $ 10,000, then the loss of 50 pips alone will be able to wipe out capital. Let's count together, 50 pips on the standard account is equal to USD 500 per 1 lot. Multiply $ 500 by 20 lots, now equal to $ 10,000 instead? Just one transaction only with the loss of 50 pips, then the entire capital money will move into the pockets of brokers:)

2. Minimum Deposit

Have you ever wondered why the brokers vying to minimize deposit to open account and not raise it?

Because the brokers understand, if necessary to open an account must deposit a minimum of USD 10,000, of course, not many can afford. Deposit is therefore minimized so that many are interested.

Not to mention the added lure, if you make a deposit of U.S. $ 100 it will be the added bonus of U.S. $ 30. Well, who is not interested in the bonus?

Once the deposit is received by a broker, then opened a live account with leverage 1:500. Imagine how good his broker's, it's been given a bonus of U.S. $ 30 is still coupled with a very high leverage is given. Well, it's someone you really trust a very bona fide broker.

Though well aware that the broker failed percentage is 95%, only 5% are able to qualify. Easy to guess what happens next is not it?

Small capital with high leverage is a deadly poison instantly. It does not matter to give a bonus of U.S. $ 30 or even U.S. $ 3,000 in advance, yet the broker a matter of time for U.S. $ 30 is returned to the pocket. Not to mention later still added U.S. $ 100 from your capital money that disappeared because of a loss:)

Brokers actually only lend to you U.S. $ 30 is. It initially seemed like a given free to you, but the percentage of failures in forex which is 95%, surely only a matter of time that money back into the pockets of brokers.

3. Slippage

Slippage is the difference in price that can be tolerated. Suppose you want to buy entry, of course, after the mouse-click order entry and then finally get to the broker server takes time. Due to the lag time, the price has changed, no longer the same as when you click the mouse.

Suppose you set at 3 pips slippage, if the price difference is not more than 3 pips, then the entry buy will be executed. However, when the difference in price is more than 3 pips, then there is requotes and you must click the mouse again to repeat the entry.

Slippage used brokers not to obstruct the entry, but to deter exit. By blocking the exit, then the loss position will experience a greater loss or profit position to have less income, due to delayed exit that position because it is difficult to be closed.

But this slippage problem arises only when not in use stop losses, take profits, or a trailing stop. However, it does not mean the use of stop losses and take profit is not problem free, this also can be utilized by the broker.

4. No Connection

This will happen many times when you can profit in large numbers so that brokers felt the need to monitor trading that you do. Ways in which the broker, at the time of obtaining profit the Metatrader trading loss made the connection alias when the connection is lost internet connection is fine, just missing the connection in Metatrader.

Due to no connection, then you can not close the position being profit. This will give time to the broker. Keep in mind, the market is always changing direction so that the profit that you earn is no longer much as before or worse, profits turned into losses. Now, if this is already happening then the connection will be activated again by Metatrader brokers. After all, if you complain the broker will stay with lightly replied "we have to check and everything is fine, maybe your computer is problematic". It is difficult to prove, is not it?

No connection is most common at high impact news. Do not expect to stop losses that have been installed will work, because it never experienced themselves.

Stop losses just did not work so the loss originally been limited to only 30 pips only, eventually to 100 pip stop losses while the line remains at its original position. At high-impact news, the price will move fast and by the accidental broker can not perform entry or exit. If not sure, please just try it for yourself, but try on a live account because brokers subterfuge is most prevalent in live and not in the demo.

5. Stop Loss Hunting

Spread is a very powerful weapon for the broker. Seldom pay attention to changes in spreads become very high in just 1 or 2 seconds, completely undetectable.

Spread is a deduction from profit and loss enhancer vice versa. For example in a loss position with a 17 pip stop loss 20 pips, the broker simply add just 3 pips on the spread for 1 second. Consequently, and triggered stop losses you suffer direct loss.

Or currently in position 27 pips profit, just wait a little longer to reach the target take profit 30 pips. Broker living increases 3 pip spreads, then the original 27 pip profit will automatically drop to 24 pip spread is due to a sudden increase. In this way, then take profit line untouched and give time to market changes so the profit decline.

Therefore, never assume that the broker is your best friend. They are actually wolves in sheep's clothing, especially the Market Maker broker. They have the interests of money capital, the more value then the loss will be more profitable for them.

Brokerage firm is built on the fact that 95% will fail in forex trading. Therefore, if you have a firm Market Maker broker and want to be successful it must be arranged so that the client experienced loss, provided that any legal way. Above methods are legal means in the forex world. Everything went very fast so it is difficult to prove.

This paper once answered my question all along, why there is a very aggressive broker to seduce the people who do not understand to trade forex with the promise of heaven as if it could be rich easily. Apparently the answer to the above, namely how to transfer money as rapidly as possible into the pockets of employers to deposit brokers. Legal way is to make the client as if losing forex making it difficult to prosecute because of course the initial contract has been mentioned 'losses will be fully borne by the client ".

In fact, without any diakal-outsmart, forex trading has been very difficult, especially if there is a trick plus in it, the sooner it disappears deposit:)

The lessons can be drawn from this paper, never entered into the world of forex with real money when capital is still not understood. The money you've earned with difficulty will soon disappear in an instant the eyes. Learn and practice first on a demo, then new to the forex world when it's actually really confident and ready.

The second type is a forex broker ECN brokers, who now began to emerge to replace Market Maker broker. ECN broker like stock brokers, they are only acting as an intermediary that connects traders with dozens of major banks. ECN broker has no interest to deposit your capital, because they fully earn money from the spreads obtained.

ECN brokers are slowly becoming popular as more and more traders who finally got it bad practice to do Market Maker broker. In addition, ECN brokers also provide a spread is much smaller, so increasingly cost-efficient trading and profits increased. Unfortunately, ECN brokers are still not many. Plus, it is still rare that supports Metatrader and required a large initial deposit to open an account. Understand it, because the main income comes only from the spread, then the deposit is required to keep trading with large lots.

Keep in mind too, the broker who claimed himself as the ECN broker is based on a written explanation on their website. Well, how do I prove that they are truly ECN brokers that will be profitable trading that we do. Um, I also do not know .... :)

Therefore, the test was made comparing the brokers: Comparing Brokers

Hopefully with these benchmarking trials, it is known that a good broker.

Stock broker will make a purchase or sale on the stock exchange in accordance with the prices that occurred at that time. Never had a stock broker, so the purchase or sale is made between the client in a different broker or brokers. It never occurred a client to buy shares from a broker, because the broker is acting as an intermediary only and not a stock trader.

Unlike in the forex, broker divided into 2 types, namely:

- Dealing Desk broker or also known as Market Maker Broker

- ECN (Electronic Communications Network) brokers

Market Maker broker is a broker that is currently the most widely encountered. They are not intermediaries like stock brokers, but act as a seller or buyer.

A simple example of such an easily understood or Bank Money Changer. You can exchange foreign currency amount to anything as you wish at the Money Changer or Bank but with the rate they've set yourself. You can not not determine its own exchange rate?

Try occasionally traveled to several Money Changer or the Bank to exchange Euro to U.S. Dollar exchange rate they charge of course vary. Though every day the official reference rate set by Bank Indonesia, but still there is a difference between the Money Changers or Banks. That difference is called spread, namely the difference between the selling and buying value.

For example, the official reference rate set for sale is a 9200 and bought the 9000. This means that if you want to sell your own property then the dollar appreciated only 9000, whereas if you do not have dollars and want to redeem the rupiah has become then have to pay 9200 dollars.

Although he has established an official reference exchange rate, but in practice or Bank Money Changer may apply its own spread, for example, selling for 9225 and bought by 8950. Therefore, applying the Bank Money Changer or spread of each there arose a difference, so if you try to get around to some or Bank Money Changer will then find that the exchange rate they charge is different. When in fact its just the same exchange rate because it has no official benchmark rate, to be different because the application of different spreads.

Such was the picture of simplicity Market Maker broker.